Why Sequans just broke the cardinal rule for Bitcoin treasuries

Sequans Communications just did something no other Bitcoin treasury company has done: it sold 30% of its Bitcoin holdings.

The move to liquidate 970 Bitcoin at around $104,000 to fund debt reduction and share buybacks represents one of two seemingly opposing paths. It’s either sophisticated financial engineering or a fundamental misunderstanding of why Bitcoin treasury premiums exist.

At the core of the company’s defense reveals a strategy far more complex that the November 4 press release suggested, but the market will ultimately decide if active trading can replace conviction.

On Tuesday, Sequans announced the redemption of 50% of its convertible debt issued just four months earlier in July 2025, funded through the Bitcoin sale. Total outstanding debt dropped to $94 million from $189 million, while Bitcoin holdings fell to 2,264 Bitcoin from 3,234 Bitcoin. Based on current market prices, the company’s Bitcoin net asset value sits at approximately $240 million, reducing its debt-to-NAV ratio to 39% from 55%.

Management framed this as “unlocking shareholder value” and providing “optionality” for future treasury optimization.

Bitcoiners weren’t happy. One called it “completely capitulating” and “the worst execution of them all,” forecasting that no serious investor would trust Sequans again. The critique centered on one key principle. Bitcoin treasury companies exist to never sell, only accumulate. Sequans violated that cardinal rule after just four months of treasury operations.

But CEO Georges Karam’s explanation reveals a more nuanced — if controversial — strategy. Karam emphasized that Sequans remains “fully committed” to its Bitcoin treasury strategy, but with a critical distinction. The primary objective is maximizing BTC per share, not total BTC holdings.

“We did not sell BTC due to volatility,” Karam told BitcoinTreasuries. “Volatility is not a concern for us, nor was it causing any operational challenges. Our decision was based on a strategic play between two variables — shares and BTC. We sell shares to buy BTC when shares trade at a premium, and we sell BTC to buy shares when they trade at a discount.”

Mathematical logic suggests there’s soundness to the strategy. Sequans issued shares at $14 to accumulate Bitcoin originally. With the stock trading at $7 — a 50% discount — selling Bitcoin at $104,000 to buy back shares at $7 theoretically increases BTC per share even though total holdings decline. If executed perfectly, the company could later re-issue shares above net asset value to repurchase the Bitcoin sold, ending with both higher BTC per share and restored total holdings.

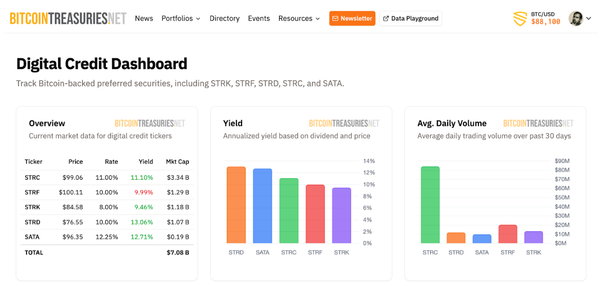

Want to see how Sequans stacks up now? Track its live Bitcoin holdings, mNAV, premium/discount, and compare it against Strategy, Metaplanet, and MARA in real time. Explore the full dashboard at BitcoinTreasuries.net.

“If we sell BTC to buy back shares at $7, we effectively generate yield in terms of BTC per share, despite a reduction in total BTC holdings,” Karam said. “Our net assets allow us to repurchase all outstanding shares and still retain $100M in cash.”

So the problem wasn’t Bitcoin volatility but rather getting trapped by valuation mechanics. With mNAV (market cap to net asset value ratio) below 1.0x, Sequans couldn’t issue shares to buy Bitcoin because dilution would destroy per-share value. Simultaneously, debt-to-NAV above 50% prevented additional debt or preferred equity issuance. The company was paralyzed, unable to accumulate regardless of Bitcoin’s trajectory.

“Even if BTC reaches $150K, the situation remains unchanged if mNAV stays below 1,” Karam explained. “I am convinced that we couldn’t stay idle doing nothing with a major discount on mNAV. We took the decision to act and defend our stock and the btc per share. If this works we can get the btc we sold in a couple of weeks.”

Karam acknowledged the move contradicts conventional Bitcoin treasury strategy but argued the specific circumstances justified the company’s intervention. Sequans redeemed only half its debt to maintain some leverage while releasing Bitcoin from collateral obligations. The 39% debt-to-NAV ratio now provides flexibility to issue preferred instruments in the future, following the Strategy playbook of permanent capital structures.

Can this active management approach work in practice? That’s the question.

Strategy, MARA Holdings, and Metaplanet have never sold Bitcoin. That unwavering conviction is precisely why their stocks trade at premiums to NAV. Investors pay above net asset value because management proves through action they’ll hold forever. Sequans just demonstrated the opposite.

Meanwhile, the execution risk is significant, for the strategy requires a precise set of circumstances to happen. Bitcoin can’t rally too much before share buybacks are complete, the stock must react positively to buybacks despite concerns regarding credibility, and the ability to re-issue shares above NAV later on after proving management will sell under pressure. Each assumption is questionable.

Markets price assets based on expectations. If investors believe Sequans will sell Bitcoin whenever debt-to-NAV exceeds 40% or mNAV drops below 1.0x, why would they ever pay premium valuations? The arbitrage Karam describes — buying back shares at $7 that funded Bitcoin purchased at $14 — only works if the stock recovers. But recovery requires credibility that selling Bitcoin inherently destroys.

Still, Karam remains confident. "I am committed to accumulate BTC as I am convinced BTC will continue growing in the coming 10 years,” he told BitcoinTreasuries. “But again my first goal is to increase the BTC per share. So if by selling a portion of the BTC I can have the treasury working again with mNAV greater than 1, I will buy the BTC I sold and more.”

Sequans is a Paris-based semiconductor business. That model provides it some cushion. Sequans’ core 4G/5G IoT operations are performing well, with management expecting substantial growth over the next years. Unlike pure treasury plays, Sequans has operational revenue that could eventually fund Bitcoin accumulation organically without capital markets dependence.

Whether this experiment succeeds or fails will establish critical precedent. Can active management — trading between Bitcoin and shares to optimize per-share metrics — generate superior returns versus the buy-and-hold conviction model? Or does selling Bitcoin, even tactically, permanently destroy the premium that makes treasury strategies work?

The answer will determine whether Sequans pioneered a new approach or simply proved why the original model exists.