Treasuries add $1.1 billion in Bitcoin as total buying falls to new 2025 lows

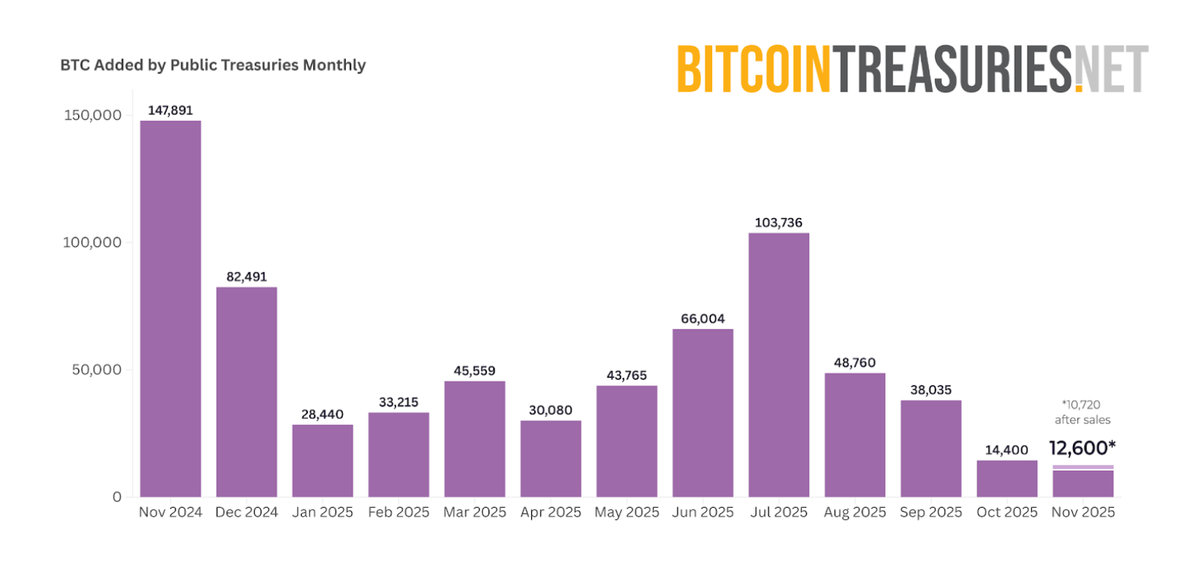

Bitcoin treasuries added more than 12,600 BTC in November — with that amount worth approximately $1.1 billion at month-end prices.

Growth was offset by significant sales, as five treasury companies reduced their total holdings by over 1,880 BTC, dragging down net additions to 10,720 BTC.

We note that a desire to execute forward-looking strategies, not merely declining market conditions, motivated certain sales, especially in the case of Sequans and KindlyMD. However, concerns about Bitcoin buying as a viable strategy amidst low mNAVs and stock prices may have contributed to reduced buying across the board.

Whether counting monthly additions or net change, November marks the month with the least additions to date this year, with total buys even lower than in October.

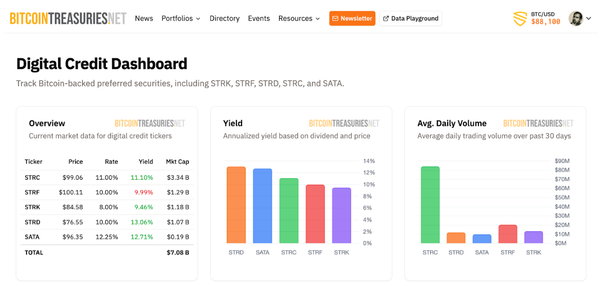

As of Nov. 30, BitcoinTreasuries.net now reports:

- Over 4 million BTC across all categories

- 1.06 million BTC held by public companies

- 279,405 BTC held by private companies

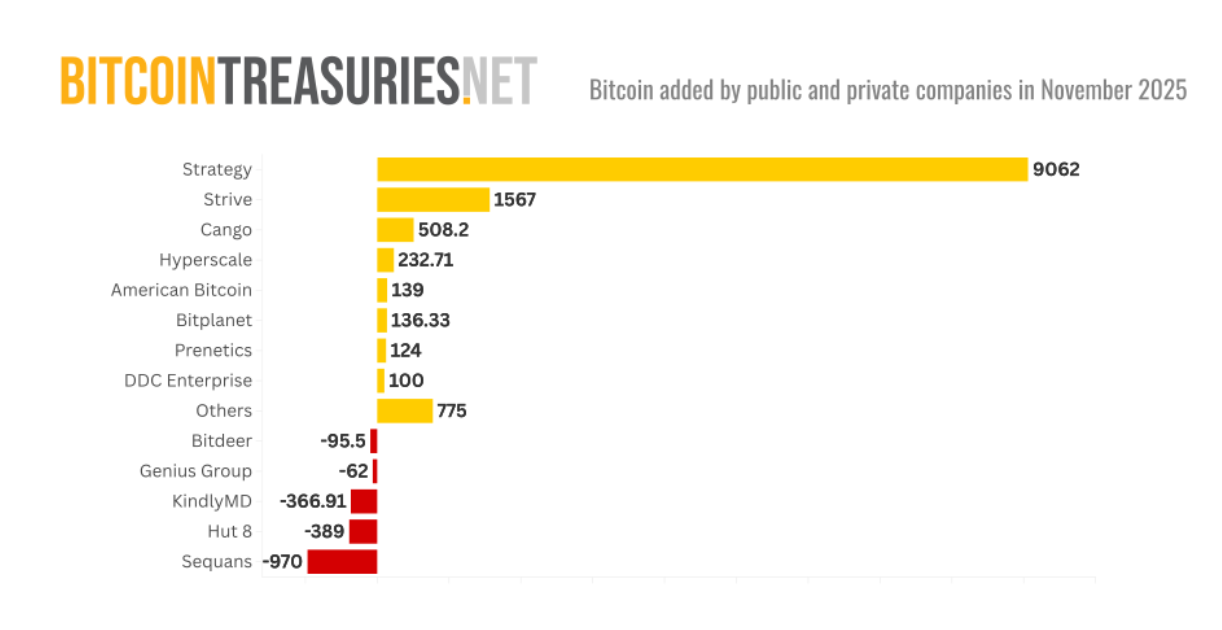

Despite reduced growth, significant purchases occurred this month:

- Strategy bought Bitcoin aggressively, adding 9,062 BTC and accounting for nearly three-quarters of November purchases

- Strive added 1,567 BTC, aided by its $160 million SATA preferred shares

- Cango added 508 BTC, driven by its mining operations

- Hyperscale Data and its subsidiary Sentinum confirmed holding a total of 382.93 BTC, an increase of 232 BTC by our count.

November sales and holding reductions include Sequans (-970 BTC), Hut 8 (-389 BTC), KindlyMD (-366.91 BTC), Bitdeer (-95.5 BTC), and Genius Group (-62 BTC).

Additionally, Trump Media’s holdings, previously estimated based on dollar value, have been disclosed considerably lower than expected. This is not reflected in the above data. (BitcoinTreasuries.net’s handling of this data is subject to change.)

The BitcoinTreasuries.net October Adoption Report covered the emergence of digital credit, Strategy’s changing dominance over treasury holdings, market performance of treasury stocks, Ethereum’s rising prominence, and several expert insights.

We’re set to publish our monthly report in the coming weeks, focusing on the role of mining companies in the Bitcoin treasury sector, the impact of recent market trends on treasuries, November’s Bitcoin sell-offs, and ongoing altcoin treasury trends.