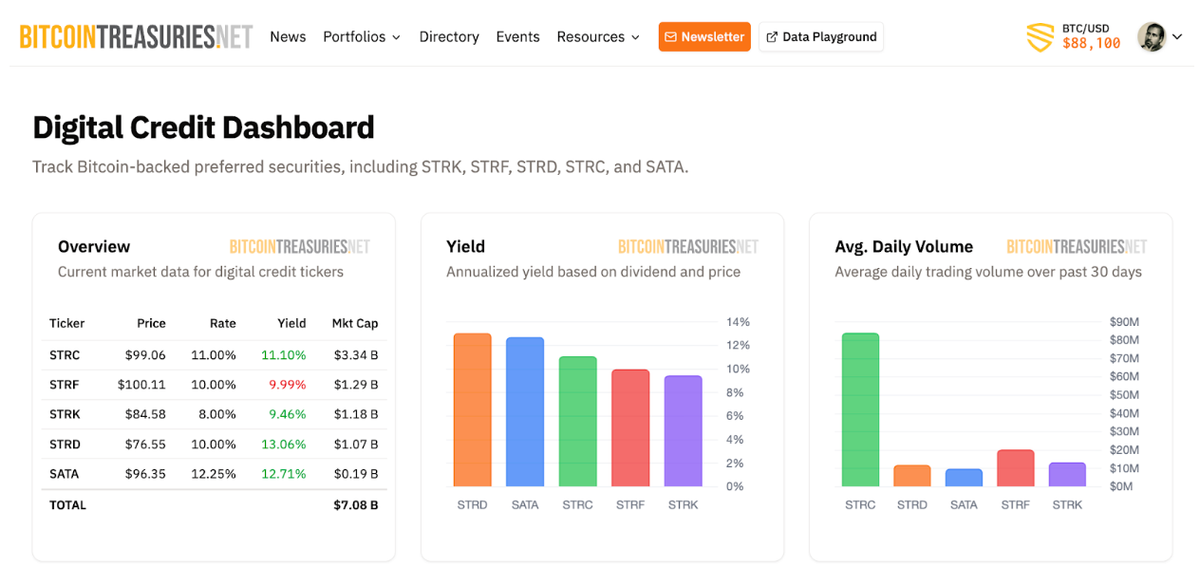

STRC to SATA: Track Digital Credit Yield and Volume With Our New Dashboard

For the first time, you can monitor Bitcoin‑backed preferred equities like STRF, STRC, STRK, STRD, and SATA using the same interface you already trust for corporate BTC treasury data.

Simply log in to BitcoinTreasuries.net and open our new Digital Credit Dashboard to see live market stats on yield, price, and trading activity for the sector’s key digital credit tickers.

Why we built the Digital Credit Dashboard

As more companies use Bitcoin‑backed debt and preferred stock to finance their treasuries, tracking these instruments has gone from interesting to essential. Until now, there hasn’t been a clean, purpose‑built way to monitor how these securities trade, what they yield, and how liquid they are over time in one place.

Our Digital Credit Dashboard closes that gap, giving allocators a dedicated view into Bitcoin treasury company preferred stockss that complements our existing corporate holdings and equity tools.

What you can track today

The dashboard is designed to answer core questions facing digital credit investors:

- Current yield: View annualized yield based on the latest dividend and market price for each supported ticker.

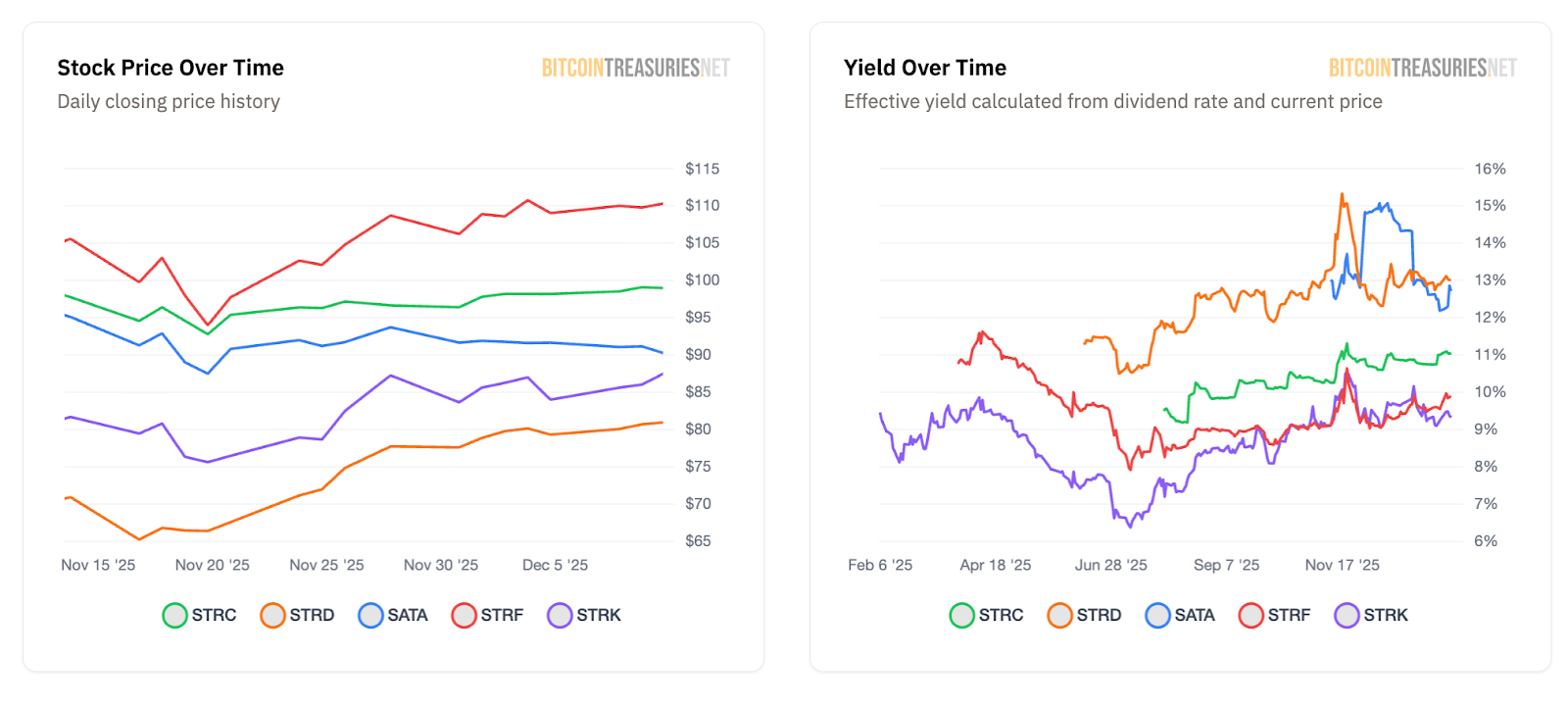

- Stock price over time: Review daily closing prices to see how each issue trades through different market conditions.

- Yield over time: Track how effective yield has moved as prices and dividends change, so you can spot dislocations or regime shifts.

- Dividend rate over time: Monitor the annualized dividend rate as a percentage of par, separate from price action.

- Average daily volume: See 30‑day average trading volume and a rolling view of dollar liquidity over time.

These series give you a fast way to judge whether a given instrument is behaving like a stable yield generator, a high‑beta trade, or something in between.

Compare structures at a glance or monitor risk in real time, and pair digital credit metrics with our corporate holdings and stock tools to see the full capital stack around key treasury names.

What’s next

Our Digital Credit Dashboard is part of our broader push to give treasuries and professional investors a complete, instrument‑level view of the Bitcoin financing stack – from spot holdings and treasury stocks to structured credit.

We’ll continue adding coverage, metrics, and analytics as new Bitcoin‑linked credit products come to market.

Ready to explore how digital credit fits into your Bitcoin treasury strategy?

→ Open the Digital Credit Dashboard: https://bitcointreasuries.net/digital-credit