Saylor Mentor Eric Weiss Joins BitcoinTreasuries.net as a Strategic Advisor

August 12, 2025 — BitcoinTreasuries.net, the world’s leading platform for tracking global institutional Bitcoin holdings, is proud to announce that Eric Weiss, the influential investor credited with mentoring Strategy CEO Michael Saylor, is joining as a strategic advisor.

By catalyzing Saylor’s multibillion-dollar embrace of Bitcoin, Weiss set off a domino effect that has transformed the corporate world. An early Bitcoin investor and founder of the Bitcoin Investment Group, Weiss’s guidance helped Saylor take Strategy from a tech stalwart to the most high-profile corporate Bitcoin holder — a play that inspired an entire generation of public and private companies.

“Eric is the godfather of institutional Bitcoin adoption, and someone who has emerged as a rare visionary in the sector” said Pete Rizzo, president at BitcoinTreasuries.net. “With a rare combination of industry insight and principled conviction, he is the ideal advisor to guide our growth for the next chapter in corporate Bitcoin adoption.”

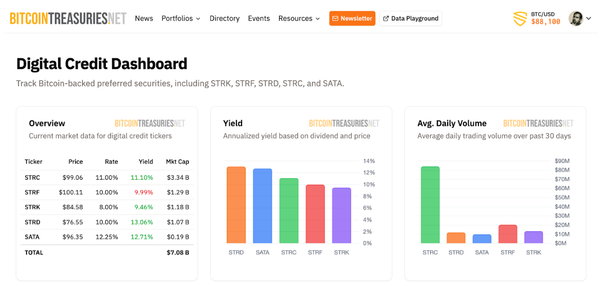

As an advisor, Weiss will draw on years of financial leadership and advocacy to amplify BitcoinTreasuries.net’s core mission: delivering real-time, trustworthy data and insights on Bitcoin adoption to investors, treasurers, and policymakers globally.

Weiss added, “I’m excited to help Bitcoin Treasuries power the next chapter of Bitcoin adoption. Data-driven transparency will be indispensable as institutions and capital markets investors look to Bitcoin for long-term value preservation.”

Weiss joins Preston Pysh who joined in August to help develop new scoring and methodology for evaluating the health and strength of Bitcoin companies.

Our initial advanced metrics dashboard is now in beta.

About BitcoinTreasuries.net

Founded in 2020 by NVK (Coinkite), BitcoinTreasuries.net provides unmatched visibility into the Bitcoin holdings of public companies, and is the premier venue for analyzing Bitcoin treasury stocks, comparing Bitcoin treasury companies, and analyzing MicroStrategy alternatives available in the global marketplace.