Pete Rizzo - Meet our new President

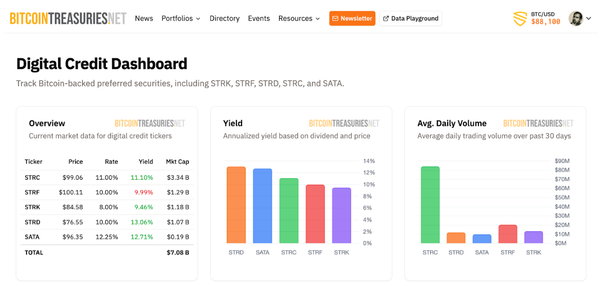

BitcoinTreasuries.net Levels Up: Tracking the Corporate Bitcoin Wave

The corporate Bitcoin movement is accelerating – and at Bitcoin Treasuries, we’re stepping up to meet it head-on.

Over the past four years, we’ve been quietly building the most comprehensive public database of institutional and corporate Bitcoin holdings. What started as a bootstrapped passion project by NVK, founder of Coinkite, is now evolving into a full-fledged platform with a clear mission: bring clarity, transparency, and insight to the companies betting big on Bitcoin.

Why this moment matters

Bitcoin adoption at the corporate level is no longer a fringe experiment. From giants like Tesla and Block Inc. making opportunistic buys with excess cash to bold plays by companies like Metaplanet leveraging convertible notes, the landscape is diverse – and growing.

Yet for investors, the challenge remains:

Which of these Bitcoin-linked companies are truly well-positioned, and how do you separate signal from noise?

A new chapter for Bitcoin Treasuries

We’re not just tracking holdings anymore – we’re expanding our tools, metrics, and reach. That’s why we recently welcomed Pete Rizzo – former editor at CoinDesk and managing editor at Bitcoin Magazine – as our president and partner. Pete brings deep editorial and analytical expertise to help us shape the next phase of the platform.

As Pete puts it:

“Everybody is kind of sleeping on and being dismissive of this trend. We see ourselves ultimately as the platform for educating and connecting the market participants.”

Growth by the numbers

Interest is surging. In the past 90 days alone, traffic to BitcoinTreasuries.net has grown 170%, with our data increasingly cited by major media outlets worldwide.

That momentum tells us one thing – investors, researchers, and decision-makers want trusted, real-time information to guide their strategies.

What’s next

Our expansion will focus on delivering:

- Enhanced company profiles – with richer data on strategy, risk, and treasury composition

- Comparative tools – so investors can analyze Bitcoin-linked companies side-by-side

- Educational resources – to help market participants understand the risks, rewards, and nuances of corporate Bitcoin adoption

The corporate Bitcoin era is here. At Bitcoin Treasuries, we’re leveling up so you can navigate it with confidence.