Michael Saylor Loves This Latin American Metaplanet — But Is It a Buy?

For years, Latin American investors who want Bitcoin exposure have had historically limited options. Those wanting liquid Bitcoin exposure without navigating banking restrictions, foreign exchange controls, and regulatory uncertainty that make direct ownership prohibitively complex have struggled.

Today, there are options. One is Mercado Libre, Argentina’s e-commerce giant with a $112 billion market capitalization. It holds 570 Bitcoin worth about $69 million on its balance sheet, but investors buy MELI stock for the marketplace and fintech business serving 70 million users across the region, not the treasury.

The company, meanwhile, trades at a 1,615x mNAV — but that multiple mostly reflects its all-encompassing e-commerce platform, not the Bitcoin holdings that represent less than 0.1% of enterprise value.

To its north, there’s Brazil’s Méliuz. The company ranks #60 globally with 604 Bitcoin worth around $73 million. The firm trades at 1.29x mNAV, but its core business is cash back rewards serving 30 million registered users. Neither of these offers pure, transparent Bitcoin treasury exposure in two of the largest economies in the region.

Oranje changes the equation entirely. Rather than embedding Bitcoin as a side treasury strategy inside an operating business, Oranje is Brazil’s first pure-play public Bitcoin treasury. At 3,650 BTC, Oranje holds four times more Bitcoin than Méliuz and Mercado Libre combined.

The difference matters.

The Structural Access Problem

Latin America’s crypto infrastructure lags behind that of developed markets.

Despite recording nearly $1.5 trillion in crypto transaction volume between July 2022 and June 2025, the region’s banking systems remain, for the most part, fragmented. Many of the major institutions continue to block crypto-related transactions or have attempted to impose punitive — and sometimes prohibitive — fees.

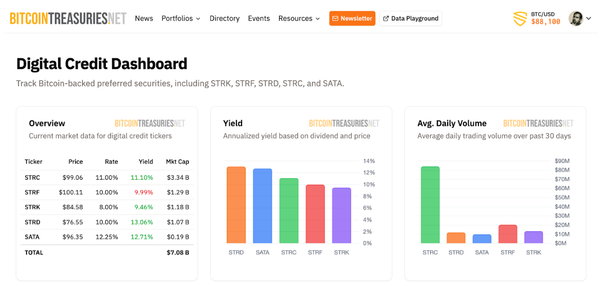

Explore our live data dashboards to make the best decision for your Bitcoin treasury stocks in Latin America → BitcoinTreasuries.net.

Yet Brazil stands apart. The country has already demonstrated massive appetite for digital financial innovation through Pix, the Central Bank’s instant payment system that reached 175 million users — 93% of the adult population — in just four years. Brazilians now complete over 6 billion Pix transactions monthly, with 76% of the population using it regularly. The system effectively replaced cash: only 6% of Brazilians use physical currency today versus 43% in 2019.

This digital payments infrastructure proves Brazilian consumers and institutions are already comfortable with instant, digital-first financial systems. The problem isn’t technological adoption — it’s that this sophistication hasn’t translated to seamless Bitcoin access. Moreover, Brazil, with its $2.3 trillion economy (10th largest globally), generates $318 billion in annual crypto flows — 33% of Latin America’s total.

Why Oranje Captures This Premium

Oranje’s 3,650 BTC — valued at over $400 million — makes it the largest corporate Bitcoin holder in Latin America by a factor of six versus its nearest competitor.

But scale isn’t the only advantage.

Pure-play structure: Unlike Mercado Libre’s e-commerce complexity or Méliuz’s cashback operations, Oranje’s valuation derives directly from Bitcoin holdings and treasury strategy. Investors get transparent NAV exposure without operational business risk that obscures the firm’s Bitcoin thesis. The entire investment case is the treasury — not a tertiary balance sheet buried in quarterly footnotes.

B3 liquidity: Trading on Latin America’s largest stock exchange provides institutional-grade liquidity and regulatory compliance. B3’s infrastructure, with $789 billion in total market capitalization across 475 listed companies, ensures tight spreads and efficient execution. For investors, this eliminates the custody risk, transfer complexity, and regulatory ambiguity of direct Bitcoin ownership.

Tax efficiency: Brazil’s equity market structure provides more favorable tax treatment than direct crypto holdings for many investor classes. Oranje effectively arbitrages this gap, offering Bitcoin exposure through standard equity holdings with clearer tax implications and lower administrative burden.

Regional tailwinds: Latin America recorded nearly $1.5 trillion in crypto transaction volume between July 2022 and June 2025. Brazil alone accounts for $318 billion — more than any other Latin American market. Monthly trading tops $3 billion in 2025, confirming sustained institutional and retail demand. This isn’t speculative adoption. In fact, it’s a structural response to inflation, currency debasement, and capital preservation needs.

High-profile validation: This week, Strategy’s executive chairman Michael Saylor publicly endorsed Oranje multiple times on social media, signaling institutional recognition from Bitcoin’s most prominent corporate advocate.

Valuation Implications

The premium question centers on execution and comparability.

Mercado Libre’s 570 Bitcoin holdings remain a footnote to its $112 billion valuation, making it impossible to extract a clear-cut treasury value. Méliuz, at 604 Bitcoin and 1.29x mNAV, offers slightly cleaner visibility but minimal scale and no pure-play focus.

Meanwhile, Oranje combines pure-play transparency with meaningful scale, creating the region’s first true Bitcoin treasury akin to U.S. and Asian peers.

At 3,650 BTC, Oranje ranks roughly #27 globally among public Bitcoin treasuries. For context, Japanese treasury Metaplanet trades at 1.28x basic mNAV with 30,823 BTC. Latin American structural demand could justify similar or higher multiples given the access premium regional investors must pay for liquid, regulated Bitcoin exposure.

The $210 million advisory agreement with Itaú BBA — Brazil’s premier investment bank — signals institutional validation. Yet this isn’t retail speculation. It’s structured finance backing from Latin America’s most sophisticated capital allocators.

Oranje solves Latin America’s Bitcoin access problem at scale. With B3 listing live, the company offers liquid, regulated exposure to the region’s fastest-growing asset class without the friction, risk, and complexity of direct ownership.

For investors seeking pure Bitcoin treasury exposure in Latin America, Oranje represents the region’s only dedicated play, and the closest structural parallel to Metaplanet’s validated Japanese model.

Oranje’s entire thesis centers on transparent NAV growth and treasury execution. The access premium isn’t speculation — it’s compensation for solving real structural barriers in a market starving for clean Bitcoin exposure.