Measure Your Bitcoin Treasury Stock Performance | Portfolio Tracking Is Now Live

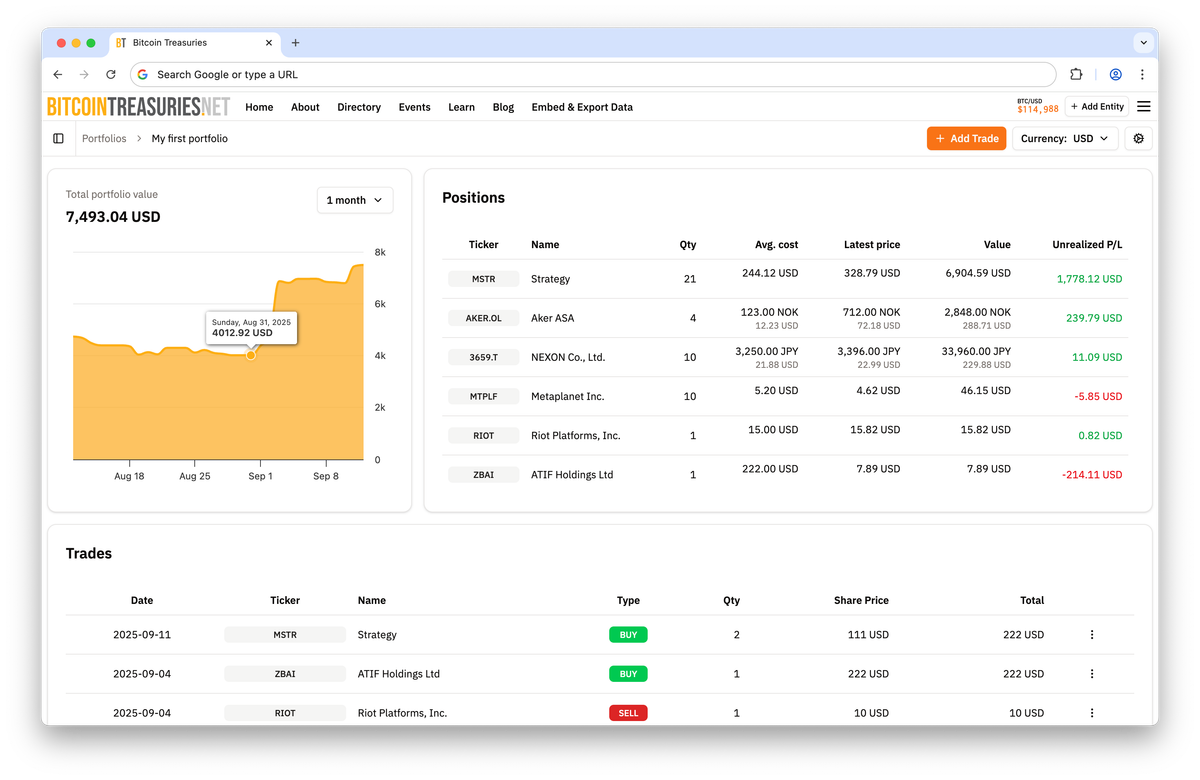

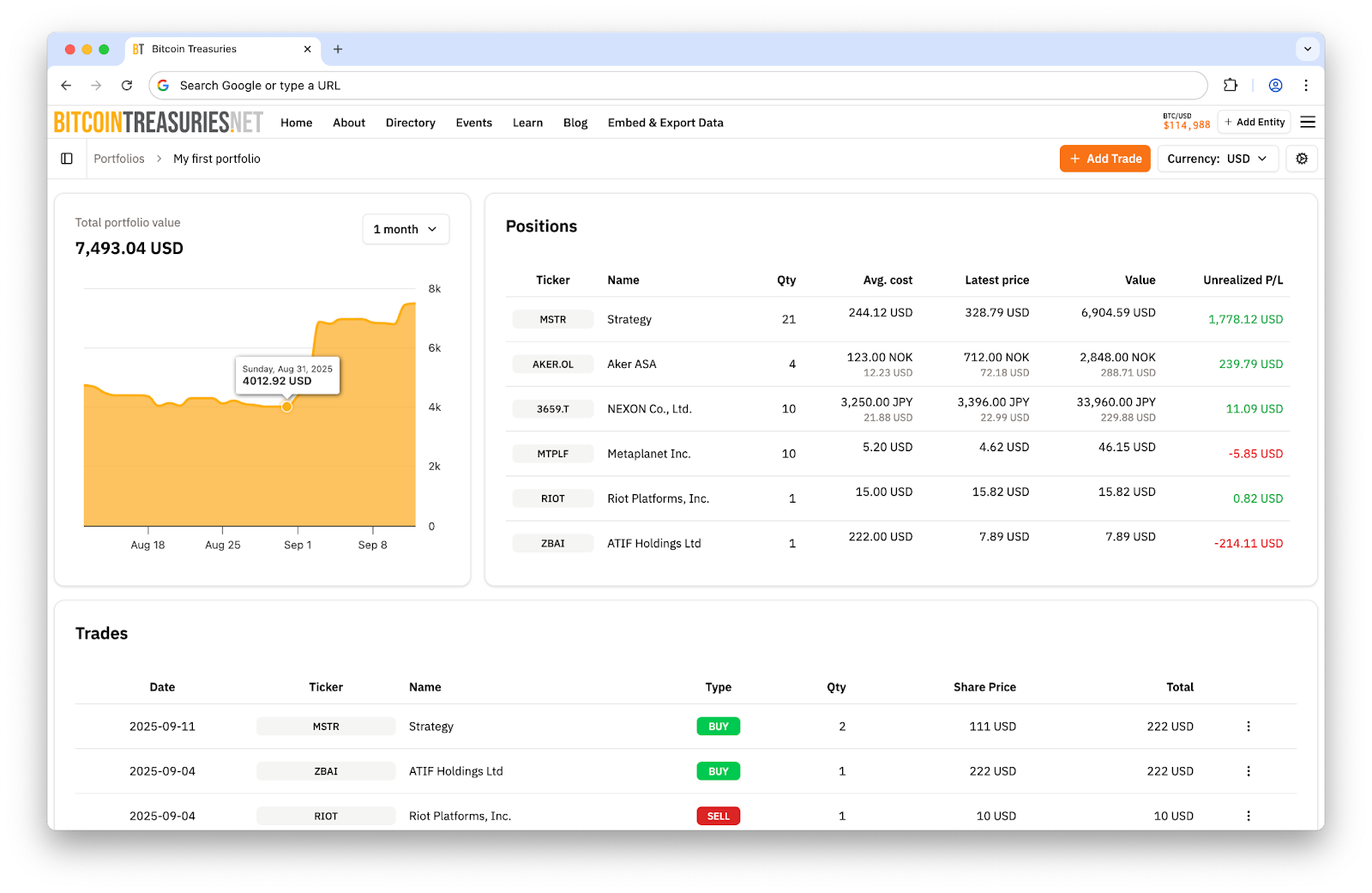

For the first time ever, you can now track your bitcoin treasury company stock portfolio with the industry’s most trusted data source – BitcoinTreasuries.net.

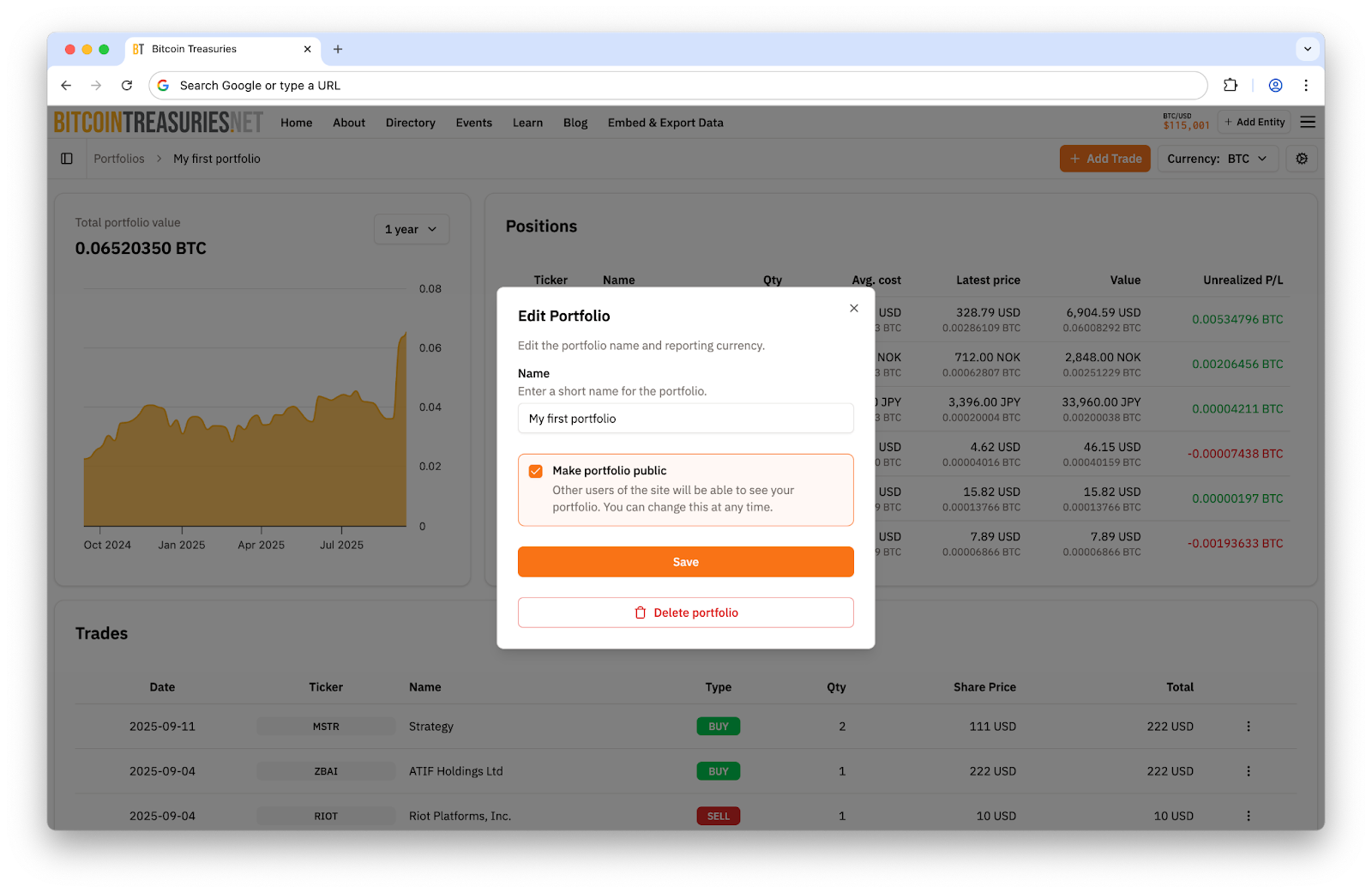

Simply log in and create fully custom portfolios combining any of our over 160 listed public companies, as well as the many exchange-traded funds, to begin modelling real-world allocations and strategies.

Measure the performance of your MSTR, MTPLF, and GME trades over time, and across dozens of major currencies, including Bitcoin.

Want to see how a basket of market leaders like Strategy, Metaplanet, or Smarter Web Company stocks would have performed? Simply add the trade data to your portfolio, set your allocations, and visualize your performance with our clean, interactive interface.

Key details:

• There are no limits on the number of portfolios you can publish or create.

• Organize and track separate portfolio strategies by region, sector, or thesis

• Compare theoretical portfolios against your actual holdings

• Share your work with colleagues or contribute your model to the broader Bitcoin treasury community by publishing them for other members (or keep them private for yourself).

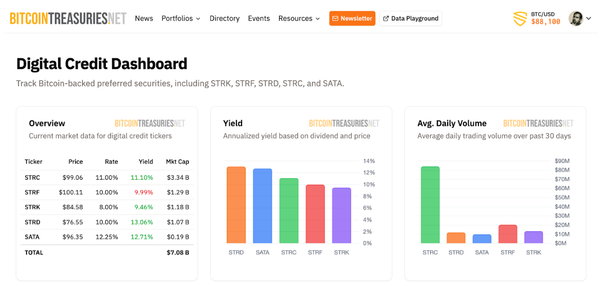

This release builds on our recent launch of Advanced Metrics tracking, which delivers deeper, more accurate insights for every company in our database.

Users now have the ability to add up-to-date stats on metrics like basic shares outstanding, fully diluted shares, cash, total debt, mNAV and Bitcoin per share. Together, these metrics enable both surface-level exploration and truly rigorous due diligence on the Bitcoin treasury sector – no spreadsheets required.

Ready to experiment or optimize your own portfolio? Sign up for a free account.