Intelligence Drop: Inside the 96,997 Bitcoin Global Buying Spree – 130 Companies Across 30+ Countries

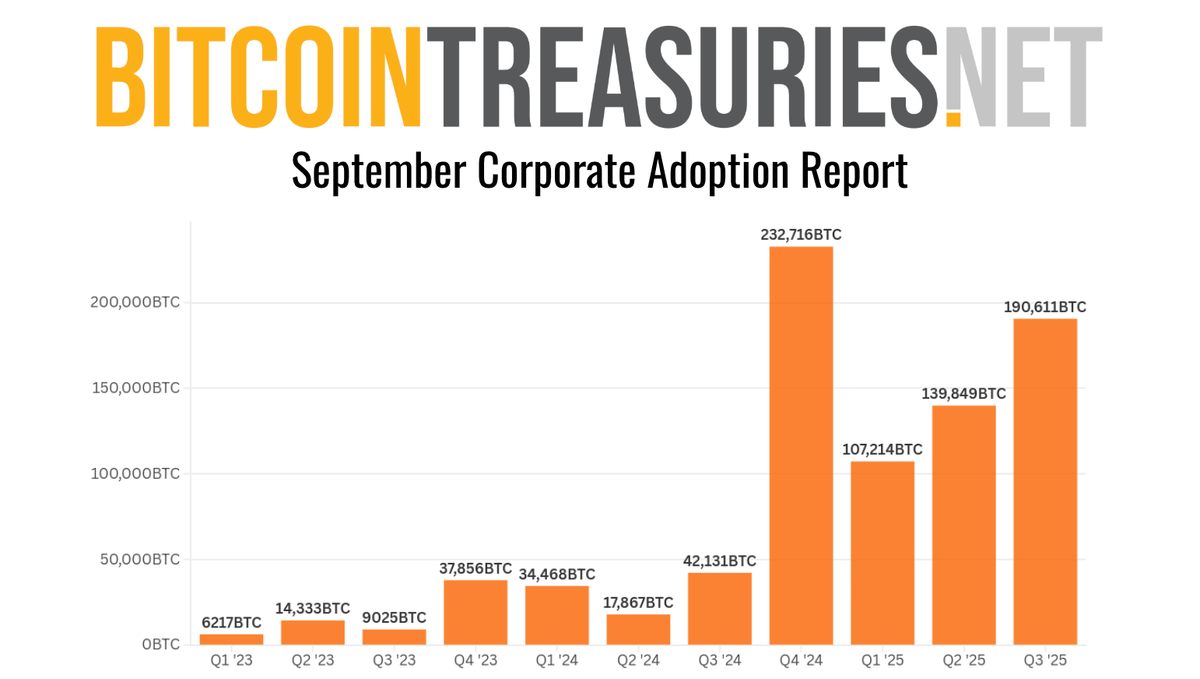

September brought another impressive round of corporate Bitcoin treasury activity – and although sentiment holds that corporate Bitcoin adoption has cooled, data shows purchases kept pace with Spring’s sector breakout.

Indeed, our new September edition of the BitcoinTreasuries.net Corporate Adoption Report shows expansion and diversification within the global capital market’s most exciting sector.

Here are this month’s takeaways:

- Global Growth Is Accelerating – There are now at least 130 public companies buying Bitcoin outside the United States, holding a combined 96,997 BTC ($12 billion). Oranje’s public listing in Brazil on B3 makes it the largest Bitcoin treasury firm in Latin America, exemplifying a new era of geographic expansion and international leadership.

- Institutional Investor Ownership Is Increasing — Even though select treasury stocks show high insider sales, leading public firms including MSTR, MTPLF, and XXI exhibit high institutional ownership. This includes holdings by index funds, investment managers, and ETFs. We believe this is a sign of sector health and maturity.

- mNAV Discipline Visible – While market concerns persist over diluted mNAVs, several leaders observe this key metric and maintain a dedicated strategy around it. Many of the largest treasury firms have maintained an mNAV close to 1, supporting disciplined equity and financing decisions even as sector averages fluctuate.

- Altcoin Treasuries Surge – Corporate Ethereum and Solana treasuries are quickly catching up to Bitcoin. ETH and SOL combined hold approximately $30 billion in treasury assets, presenting a complement to Bitcoin exposure.

- Fundraising Remains Robust – September saw $5 billion in new and continued treasury-related fundraising. Companies utilized a spectrum of capital strategies, including convertible notes, SPAC and PIPE transactions, credit lines, and ATM programs — all reflecting maturity and capital flexibility across the sector.

- Insights from Top Experts – Brian Brookshire, Head of Bitcoin Strategy at H100, Oranje founder Guilherme Gomes, Capriole Investments founder Charles Edwards, MSTRTrueNorth’s Adrian Morris, and Joe Burnett, Director of Bitcoin Strategy at Semler Scientific, provide novel insight on industry trends.

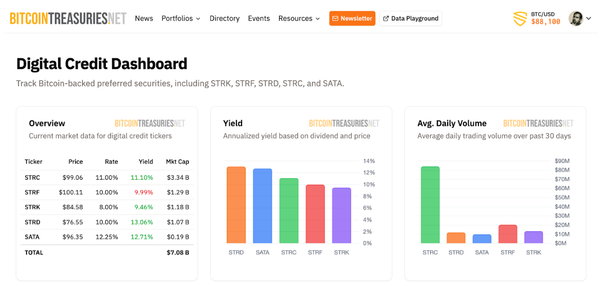

Our mission is to remain the essential dashboard for monitoring corporate digital asset strategy.

Which advanced metrics, dashboards, or features would make your analysis even more effective? Email office@bitcointreasuries.net today.