How Strategy just invented Bitcoin credit

Strategy just proved that Bitcoin treasury finance has permanently evolved beyond equity dilution.

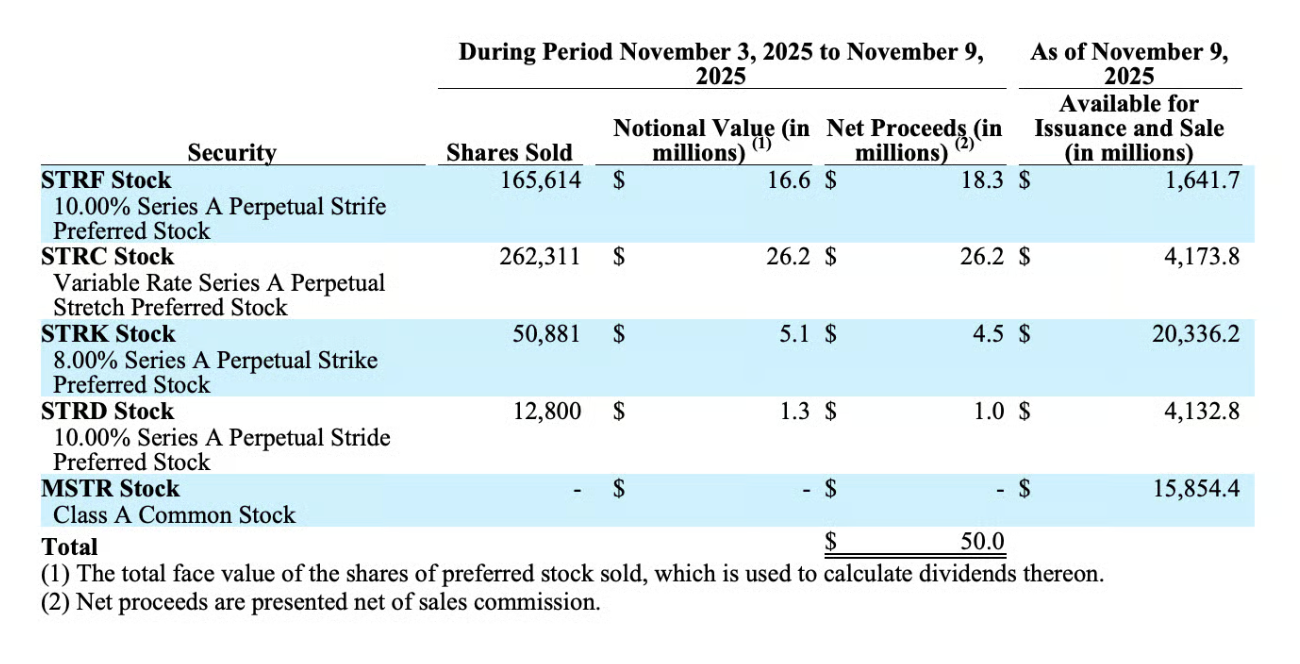

Just last week, the company bought $50 million worth of Bitcoin almost entirely through preferred stock issuance — with 52% (around $26 million) coming from STRC, its Variable Rate Series A Perpetual Stretch Preferred Stock — without selling a single share of common MSTR stock. It’s the first of its kind since it launched its preferred equity program in July.

This marks the birth of “Bitcoin Credit,” an institutional-grade fixed-income securities backed by Bitcoin collateral that has the potential to unlock capital from investors who cannot participate through equity markets.

Moreover, the significance extends far beyond the $50 million capital raise. Strategy’s November 3-9 securities filing reveals the company sold 262,311 shares of STRC at par value, generating $26.2 million in net proceeds. Simultaneously, it issued STRF ($18.3 million), STRK ($4.5 million), and STRD ($1 million ) preferred tranches while selling zero MSTR common shares.

This capital structure — 100% preferred equity, 0% common stock — demonstrates that Michael Saylor’s multi-year build toward permanent capital markets infrastructure has finally reached operational maturity. Instead of diluting common shareholders, the company can now fund its Bitcoin purchases indefinitely through fixed-income securities that pay 8% to 10% dividends to investors.

STRC’s role as the dominant funding source validates recent market developments. Just days before the firm’s latest capital raise, STRC broke through $100 par value for the first time, closing at $100.01 with record trading volume.

ZynxBTC called it “the iPhone moment,” claiming “$1 trillion will pour into STRC over the next 10 years.” That statement seemed like typical promotional hyperbole until this filing proved STRC now functions as Strategy’s primary capital raising vehicle. The preferred stock trading at or above par creates liquid secondary market demand, allowing the company to issue new shares to institutional investors who are confident they can exit positions without taking losses below face value.

Capital markets mechanics reveal why this matters. Traditional institutional fixed-income investors — pension funds managing liability-matching portfolios, insurance companies meeting reserve requirements, bond mutual funds operating under explicit mandates — cannot buy MSTR common stock regardless of their conviction about Bitcoin. The main reason is because investment policies explicitly restrict equity purchases, limiting allocations to investment-grade bonds, high-yield debt, and preferred securities meeting specific criteria.

A $100 billion pension fund might allocate 60% to fixed income and 40% to equities, but the fixed-income mandate prohibits it from buying even the highest-quality common stock.

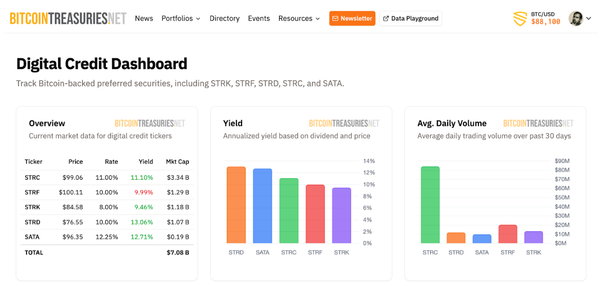

STRC solves this structural barrier. As a perpetual preferred equity that pays out variable-rate dividends while trading at par, STRC qualifies for fixed-income allocations despite providing indirect Bitcoin exposure. The security pays quarterly dividends, offers priority claim over common shareholders in liquidation scenarios, and trades on public markets with daily liquidity.

For fixed-income portfolio managers seeking Bitcoin exposure without violating their mandates, STRC represents the only viable option beyond Bitcoin ETFs. And unlike spot ETFs that simply track price, STRC provides both yield and exposure to Strategy’s systematic accumulation strategy.

The addressable market is enormous. Global fixed-income asset management totaled approximately $78 trillion in 2025 according to industry research, dwarfing the equity markets that have driven MSTR’s valuation to date. U.S. institutional investors alone manage over $30 trillion in fixed-income assets across pension funds, insurance companies, endowments, and bond funds. Even if just 0.5% of that capital eventually allocate to Bitcoin-backed preferred securities, that figure rises to $150 billion in potential demand — roughly double Strategy’s current $77 billion market cap.

Strategy’s capital raise demonstrates the feedback loop Saylor has engineered. The company issues preferred equity (STRC, STRF, STRK, STRD) to raise capital, uses proceeds to buy Bitcoin, which increases the net asset value that backs the preferred securities, to then supports continued issuance at par or premium, enabling more Bitcoin purchases.

As long as Bitcoin appreciates or remains stable, this cycle perpetuates indefinitely. The preferred dividends are funded through additional preferred issuance or eventual common equity raises when MSTR trades at sufficient premium, creating a self-sustaining capital structure that doesn’t require selling Bitcoin.

The risks mirror the rewards. If Bitcoin crashes severely, Strategy’s ability to pay preferred dividends becomes strained. While the company can defer dividends on all preferred tranches, doing so triggers penalties. Some clauses grant preferred holders board seats after four consecutive quarters of missed payments, while others accrue compounding interest on deferred amounts at higher rates.

Meanwhile, a prolonged Bitcoin bear market could force Strategy to sell holdings at depressed prices or restructure preferred securities in ways investors might consider tantamount to default, destroying the credibility that makes the entire structure function.

Other Bitcoin treasuries will likely replicate this playbook. MARA Holdings, Riot Platforms, Metaplanet, and every serious accumulator now has proof that preferred equity works as a key funding source. The race begins to establish liquid preferred securities with institutional acceptance before markets become saturated.

First movers like Strategy benefit from name recognition and trading volume that creates self-reinforcing liquidity, but competitors with strong operational businesses (MARA’s mining cash flow, Coinbase’s exchange revenue) could argue for lower dividend rates based on their reduced risk profiles.

Strategy’s $50 million raise — with 52% from STRC and zero common stock dilution — transforms Bitcoin treasury finance from an equity story to a fixed-income asset class. The institutional capital that couldn’t participate before now has access. Still, whether this represents genius financial engineering that permanently alters corporate treasury management or 2008-style structured finance that unwinds catastrophically depends entirely on one variable: does Bitcoin go up?