Fully Diluted Shares Data Now Available for the Top 100 Bitcoin Treasury Firms

Investors can now track fully diluted share data for the top 100 Bitcoin treasury firms, all on BitcoinTreasuries.net’s leading homepage.

A critical metric for evaluating public digital asset treasury companies, fully diluted shares provides a more comprehensive view of each company’s equity structure: including options, warrants, convertible securities, and preferred shares, so users can assess the full extent of share-based claims on treasury holdings.

For Bitcoin treasury companies, understanding FDS is essential because it directly affects key valuation metrics, signals potential shareholder dilution, and indicates each firm's capital raising capacity for future Bitcoin purchases.

By factoring in all possible dilutive securities, investors gain clarity on ownership, risk, and the company’s ability to deploy capital more effectively.

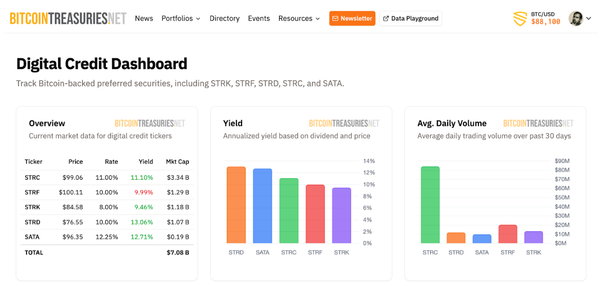

What’s new for analysts and investors:

- Each company now displays both reported and fully diluted BTC-per-share figures, so you can compare "headline" and adjusted ownership side-by-side.

- Advanced metrics like mNAV (multiple of Net Asset Value) and Bitcoin per share on a fully diluted basis now reflect investor premium and capital efficiency more precisely.

- mNAV offers insight into a company's market capitalization compared to Bitcoin holdings—once dilution is factored in, it's much easier to spot which treasuries are growing share value versus diluting it.

- BTC per share on a fully diluted basis helps reveal how much Bitcoin equity holders effectively control, accounting for all possible share expansion.

- Companies like Strategy, Marathon, and Metaplanet have raised new capital via frequent share issuances, but only fully diluted data shows the real impact of these moves.

As a reminder, all BitcoinTreasuries.net users can help us maintain and monitor this data, entering information, which is then reviewed by our team of in-house data experts.

For up-to-date information, you can visit the Advanced Metrics section for each company listed on BitcoinTreasuries.net.