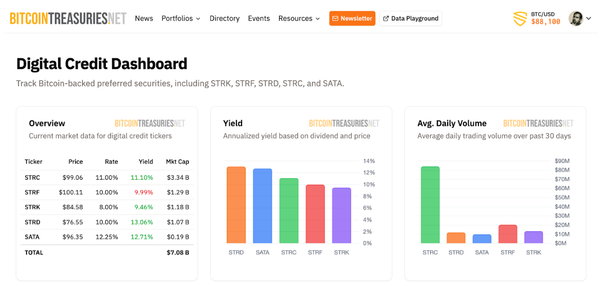

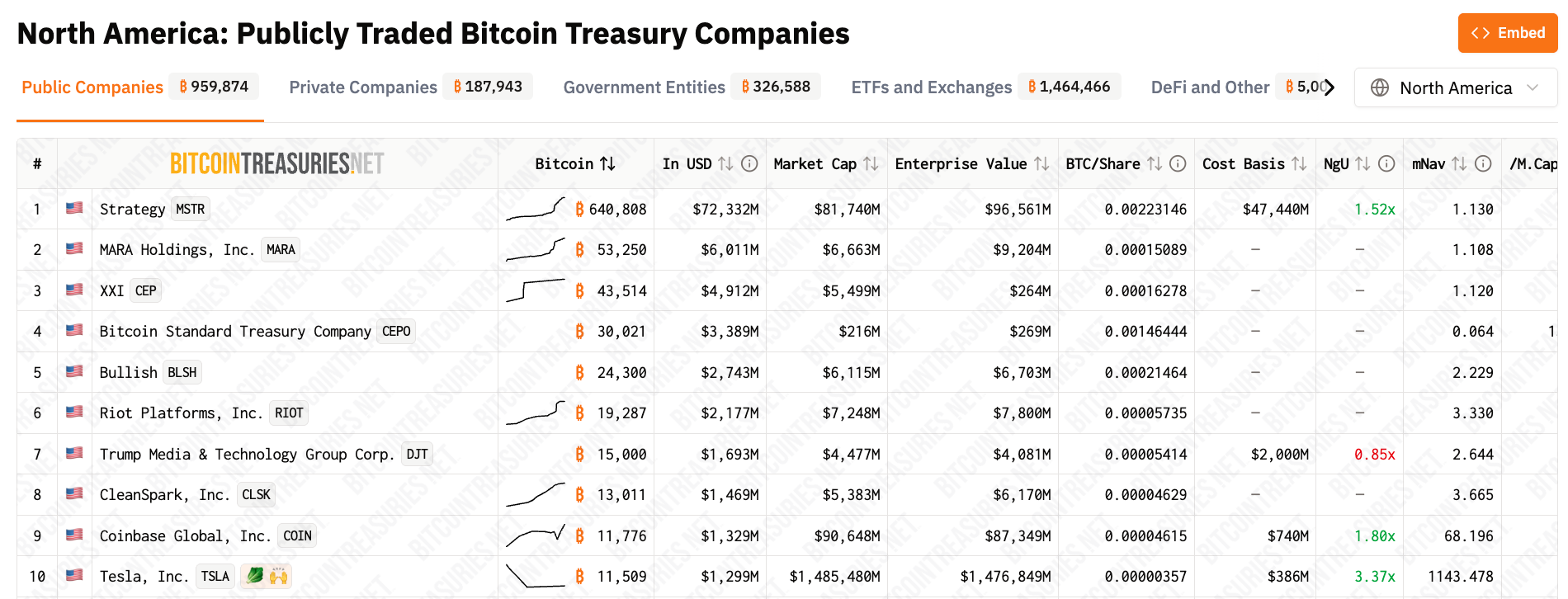

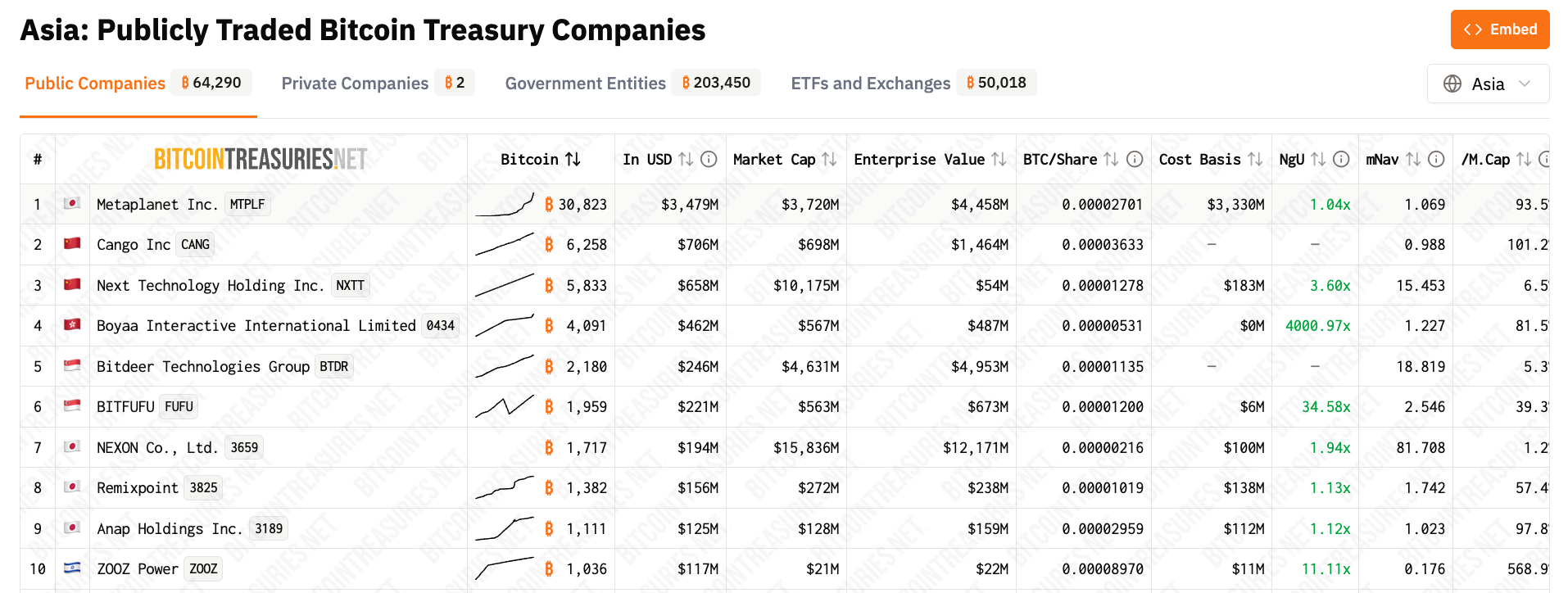

Discover Which Global Regions Are Leading Corporate Bitcoin Adoption

The global race for Bitcoin and digital asset adoption is accelerating — and now, you can track it by region.

We've just launched new regional ranking pages that showcase which countries, corporations, and institutions are leading the charge in bringing Bitcoin onto balance sheets across global markets.

Each page highlights the most influential digital asset treasury companies, public and private holders, and regional trends shaping institutional engagement with Bitcoin. For the first time, users can directly compare adoption strength, treasury size, and holdings concentration across continents — revealing where Bitcoin’s corporate influence is growing fastest.

Led by market pioneer Strategy, North America leads the way in total adoption, and dominates the Top 10 in corporate adoption globally.

Not to be left behind, Asia is perhaps the fastest growing region, led by sector powerhouse Metaplanet, but featuring a number of inspiring upstarts like Cango, Next Technology, and Boyaa.

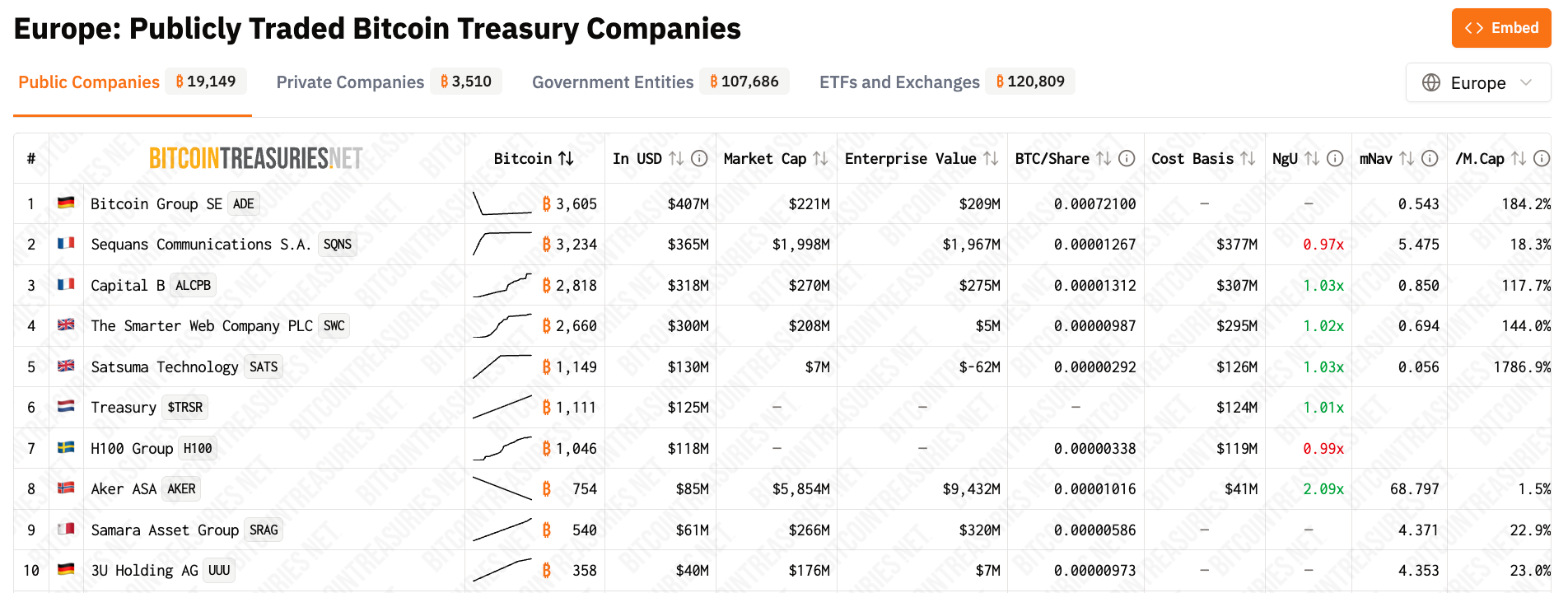

A growing category, Europe's companies are currently led by Bitcoin Group SE out of German, but competition from Sequans and Capital B remains fierce.

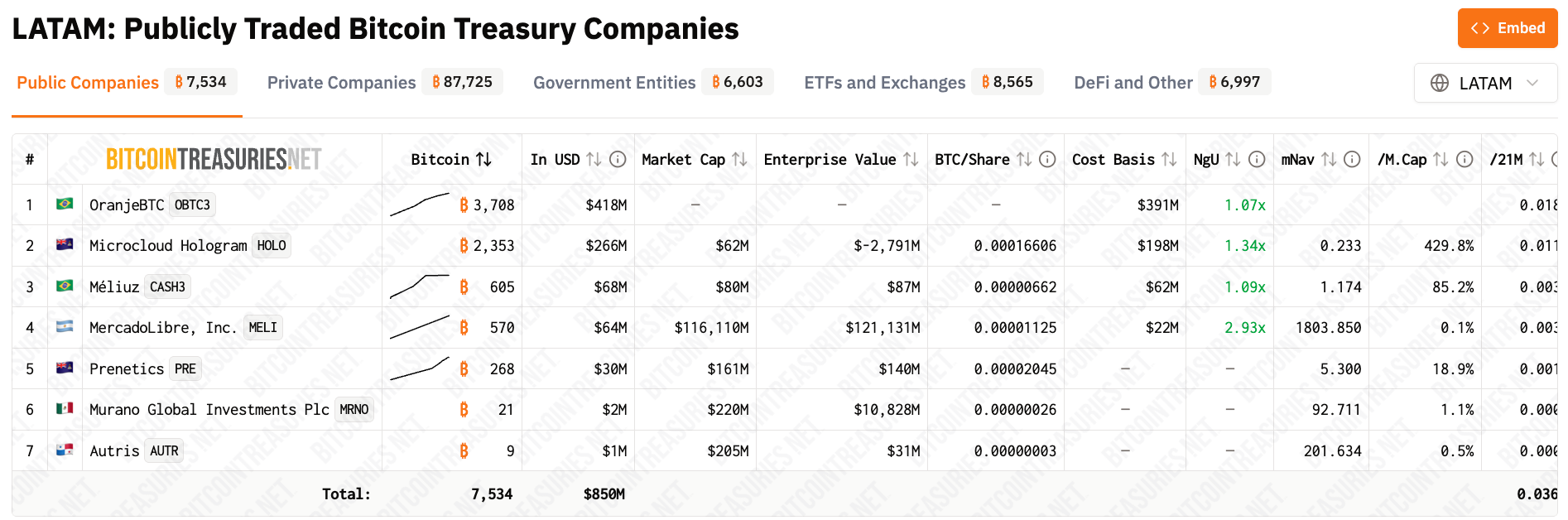

A region that has seen recent growth, it's dominated so far by Brazil, which boasts two of the region's top three companies by total holdings.

This new feature builds on BitcoinTreasuries.net’s mission: to bring transparency and insight to the global movement behind corporate Bitcoin and digital asset adoption. By visualizing adoption by region, we aim to make Bitcoin’s global financial footprint clearer, data-backed, and verifiable.

Discover which regions are setting the pace — and which treasuries are defining the next chapter of institutional Bitcoin growth.

Explore the full data set now at BitcoinTreasuries.net.

.