Broken PIPEs: Is Now the Time to Buy ASST, NAKA?

Several Bitcoin treasuries are trading below their net asset value after PIPE share unlocks crushed their stock prices.

Nakamoto (NAKA) trades at 0.52x mNAV with a $329 million market cap against 5,765 BTC valued at $634 million — a 48% discount to its BTC. Strive (ASST) hovers at 0.848x mNAV with a $549 million market cap against 5,885 BTC worth $647.65 million — a 15% discount.

Two questions come to life: Are these broken stocks or broken prices? Does the unlock cascade create contrarian buying opportunity, or do sub-NAV valuations signal permanent value destruction?

Understanding the mechanics behind PIPE deals is critical to answering this. Private Investment in Public Equity deals allow companies to raise capital by selling shares to institutional investors at discounts to market price. Typically, this cohort of capital allocators buy stock 20% to 40% below prevailing prices. In exchange for the discount, buyers accept lock up periods (that usually extend from 90 to 180 days), which prevents immediate sell-offs.

When lock-ups expire, however, supply floods the market. PIPE holders who bought at favorable terms — assuming share prices rose since they went public — can then sell at significant profits even as the stock crashes. Retail investors then absorb that downward selling pressure.

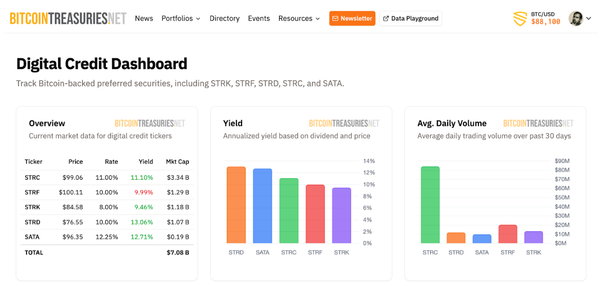

Track post-PIPE treasury performance on our live dashboard: Monitor real-time mNAV changes, identify companies trading below Bitcoin NAV, and compare capital structures across 100+ Bitcoin treasuries.

NAKA’s collapse exemplifies PIPE destruction at scale. The company raised $763 million, including $563 million in PIPE financing to buy Bitcoin. Since its May 2025 Bitcoin treasury debut, shares have collapsed from the mid-to-high $20s to its current price of $0.80.

With 413 million shares outstanding and a $329 million basic market cap against 5,765 Bitcoin worth $635 million, NAKA trades well below the value of its Bitcoin holdings. For a company that dubs itself a Bitcoin treasury of Bitcoin treasuries, the figures are not auspicious. Indeed, the discount to NAV signals that the market assigns negative value to management, operation, and future execution.

Strive (ASST) presents a different but also troubled post-PIPE situation. The company raised $750 million via PIPE at around $1.35 per share — a 121% premium to pre-merger prices — to fund its 5,885 Bitcoin acquisition. Shares have since fallen to $0.86, a 36% decline from the PIPE price. With a $549 million basic market cap against $647.2 million in Bitcoin holdings, ASST trades at 0.848x basic mNAV.

The diluted picture is more complex: a $1 billion diluted market cap yields 1.869x diluted mNAV, but the 0.829x EV mNAV suggests the enterprise value barely covers Bitcoin holdings once debt is factored in.

The Bull Case: Post-Unlock as Opportunity

Contrarian investors see value in post-PIPE wreckage.

The logic: all the technical selling is finished. PIPE holders have exited, removing the structural overhang that depressed prices. With supply cleared, stocks can finally track Bitcoin’s performance without artificial selling pressure. Companies trading below 1.0x mNAV offer Bitcoin at a discount — buy the stock, liquidate the treasury, profit from arbitrage.

NAKA at 0.52x mNAV offers a staggering 48% discount to its $634 million Bitcoin holdings. If an investor bought the entire $329 million market cap and liquidated the Bitcoin treasury, they'd theoretically realize $305 million in immediate profit.

Meanwhile, ASST at 0.848x basic mNAV provides a 15% discount to its $647.65 million holdings. These discounts exist because markets fear value destruction, but contrarians might argue that the fear is overblown. Capitulation post-unlock can create maximum pessimism and minimum prices.

If management for both of these companies can restore credibility while resuming systematic accumulation funded by non-dilutive sources, then these equities should re-rate towards a fair value.

For instance, NAKA could compress to 1.0x mNAV from 0.52x — offering investors a 92% return — just from multiple expansion with zero Bitcoin appreciation required. On the other hand, if ASST were to move to 1.0x from its current 0.84x then investors would reap a 41% upside. The post-PIPE bottom creates the classic value opportunity. Assets trading below liquidation value due to temporary technical pressure rather than permanent impairment.

The Bear Case: Why the Discount Exists

Markets aren’t inept.

Sub-NAV valuations exist because investors expect continued value destruction. NAKA's 98% collapse to $0.80 from from $34.77 isn't just PIPE unlock pressure — it’s total market rejection. The company can’t raise capital at these valuations without further destroying per-share NAV. And without more capital, it can’t buy Bitcoin. Without purchases, premiums stay compressed. The doom loop continues until liquidation.

ASST’s situation is less dire but still problematic. At 0.848x basic mNAV, the 15% discount reflects market expectations of dilution or value leakage. The company bought 5,885 BTC at $114,923 average cost, now showing -4.24% unrealized loss.

Moreover, the $750 million PIPE raise at $1.35 per share positioned institutional buyers at what seemed like reasonable terms, yet even PIPE investors likely face losses if the stock trades near the 0.848x mNAV implied valuation.

Even more damning is the fact that neither company has shown any ability to accumulate systematically more Bitcoin post-PIPE. Without continued Bitcoin purchases, they’re not treasury companies. Instead, they turn into static Bitcoin holders that trade at discounts because markets expect the holdings to shrink through forced sales or operational costs.

The Framework: Evaluating Post-PIPE Opportunities

Not all post-PIPE treasuries are value traps. Some face temporary technical pressure that creates genuine entry points. The key is distinguishing between structural problems and transient selling.

Has all PIPE supply cleared? Check SEC filings for remaining lock-up schedules. NAKA’s continued decline suggests either more unlocks are coming or fundamental deterioration beyond PIPE selling.

Is the company still accumulating? Post-PIPE treasuries that announce continued Bitcoin purchases signal management commitment. Silence suggests capitulation.

Does management have credibility? ASST‘s merger surge followed by 91% decline destroys trust. NAKA’s fall from to $0.80 from $34.77 eliminates most of the company’s credibility . These aren’t technical corrections — they’re votes of no confidence.

Can they access capital non-dilutively? At 0.84x and 0.48x mNAV, neither company can issue equity without destroying per-share value. They need operational cash flow or debt financing, which neither has demonstrated.

What's the mNAV trajectory? NAKA compressed from 23x to 0.48x. ASST trades at 0.84x. These could be compressions although signs point, in NAKA’s case at least, toward collapse.

Explore our comprehensive Bitcoin treasury database: Filter by mNAV multiples, compare PIPE vs ATM financing structures, and analyze which companies are accumulating systematically versus facing capital constraints — all updated in real time.

What’s noteworthy is that when companies resort to large PIPE raises with aggressive discounts, they reveal inability to access capital on normal terms. Healthy treasuries like Strategy use ATM offerings that sell shares at market prices, aligning all shareholders.

PIPE structures with institutional discounts create misaligned incentives and predictable post-unlock selling. The fact that even PIPE investors likely face losses (ASST raised at $1.35, now implied around that level or below, while NAKA’s PIPE terms unclear but holders clearly liquidating at losses) proves the entire capital structures were mispriced from inception.

For investors seeking genuine value in distressed Bitcoin treasuries, the checklist is clear: look for management that bought Bitcoin at favorable prices (creating unrealized gains, not losses), demonstrated systematic accumulation discipline, communicated transparently throughout unlock periods, and never traded below 1.0x mNAV even during technical pressure.