Bitcoin treasuries add 30,000 BTC in December – dominated by Strategy

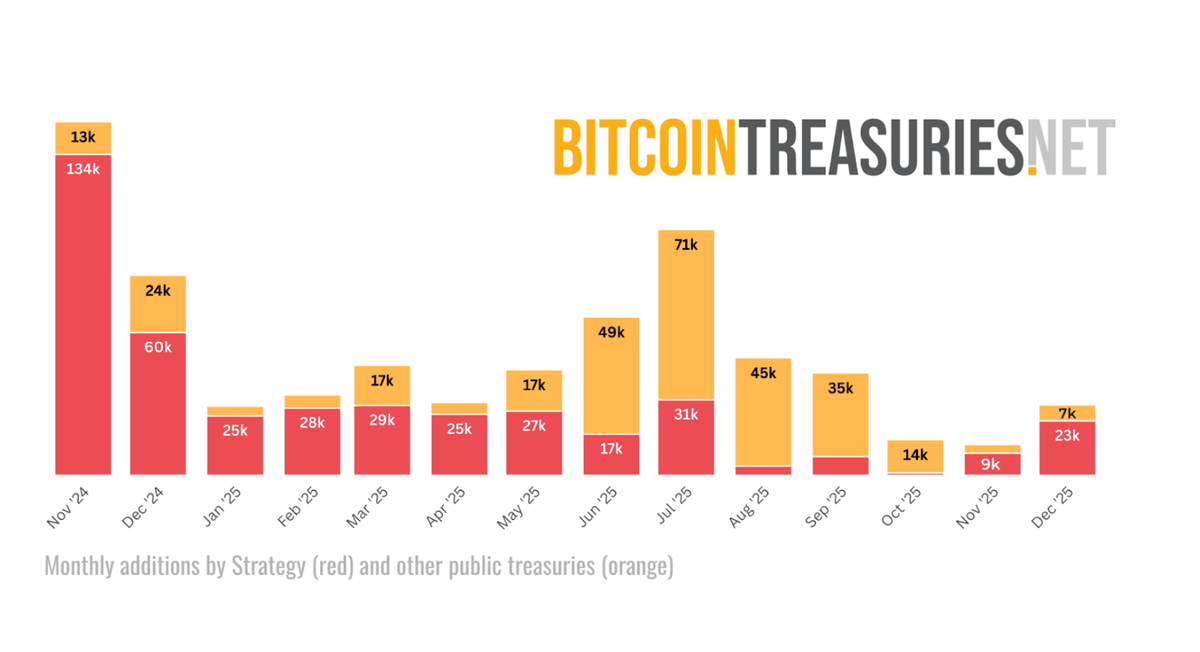

Publicly traded Bitcoin treasuries added nearly 30,000 BTC during December 2025, worth approximately $2.6 billion at month-end prices.

This marks an uptrend in monthly Bitcoin purchases, outpacing October and November combined. It also brings public companies’ additions in Q4 2025 above 52,000 BTC, surpassing our projection that treasuries would add 40,000 BTC this quarter.

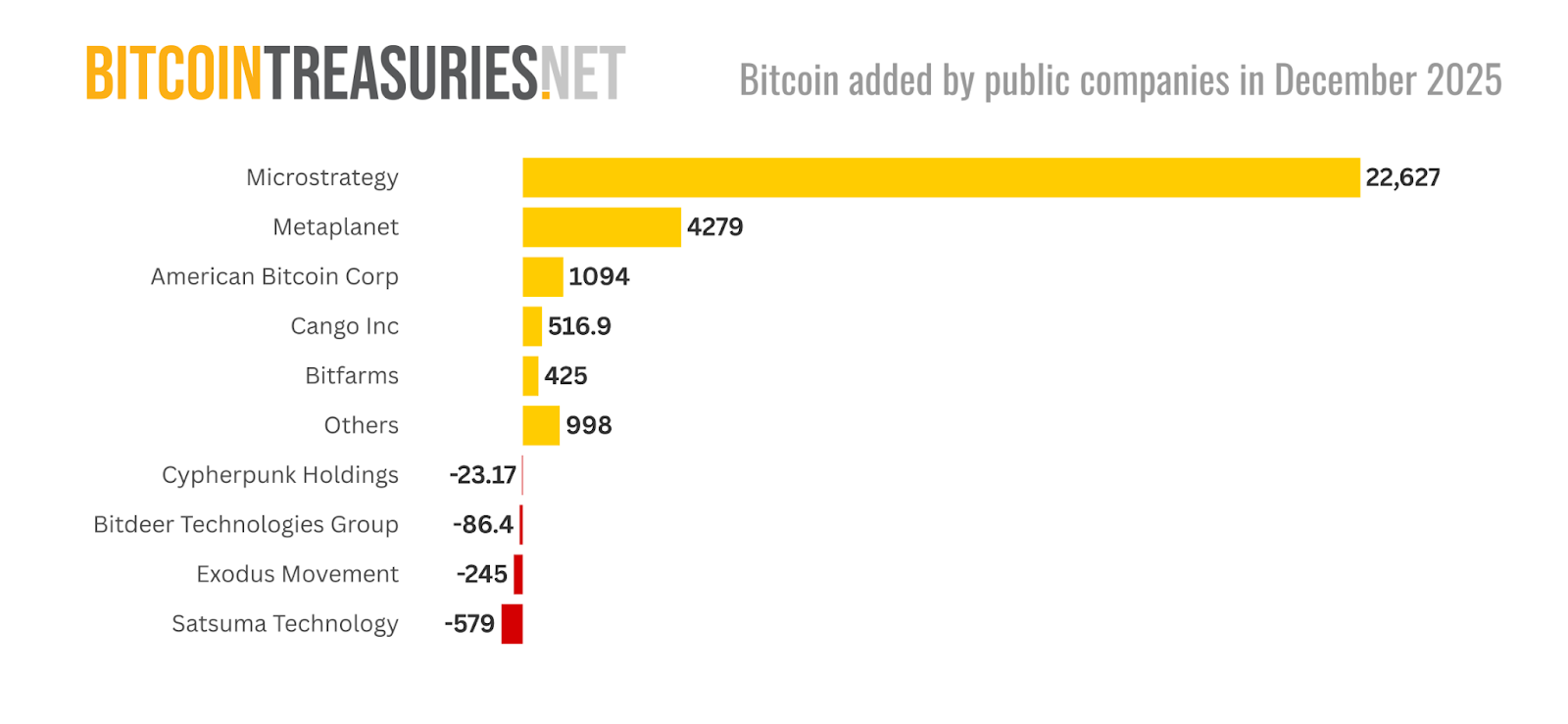

We observe that December buying was driven almost entirely by Michael Saylor’s Strategy, which bought 22,600 BTC in December. This marks Strategy’s biggest buying month since July, brings the company’s total holdings to 672,497 BTC, and accounts for 75% of all companies’ December additions (or 78% of net additions after sales).

Other major additions in December include:

- Metaplanet’s purchase of 4,279 BTC, raising its holdings to 35,102 BTC — just 8,400 BTC less than the third-largest public treasury, XXI

- American Bitcoin’s addition of 1,094 BTC, bringing its holdings to 5,098 BTC and reporting BTC Yield of 96.5% since its September Nasdaq listing

- Cango and Bitfarms’ 516.9 BTC and 425 BTC, added through mining activity

As of Dec. 31, BitcoinTreasuries.net now reports:

- Over 4 million BTC across all categories

- 1.09 million BTC held by public companies

- 279,414 BTC held by private companies

We also observed more than 930 BTC in net holdings reductions this month, bringing net additions down to approximately 29,000 BTC overall.

Key reductions include Satsuma Technology (-579 BTC), Exodus Movement (-245 BTC), Bitdeer (-86.4 BTC net), and SOL Strategies (-23 BTC).

The BitcoinTreasuries.net November Corporate Adoption Report examined the value of corporate holdings amid sinking Bitcoin prices, the dominance of Strategy over the treasury sector, and the emergence of significant treasury sales.

We’re set to publish our next report in the coming weeks, focusing on monthly holdings change, the year in review, and the results of our first annual survey.