|

|

|

Hello and welcome to Bitcoin Balance Sheet, the twice-weekly email from Bitcoin Treasuries, where we track the latest in corporate Bitcoin buying.

|

|

Each Monday, you’ll receive a quick blast on the top buyers over the last week. We’ll follow that up every Friday with digest and analysis. Enjoy!

|

|

|

Master Corporate Bitcoin Strategy — Register Now

|

|

Unlock the skills Fortune 500 finance teams use to master Bitcoin. Join our new Bitcoin Treasury Masterclass with expert Charlene Fadirepo (ex–US Regulator, bestselling author).

|

|

In just 90 minutes, you’ll get:

|

Strategic frameworks for using Bitcoin as a treasury asset Deep-dive case study on MicroStrategy’s playbook Security, tax, and risk best practices Step-by-step deployment roadmap and live Q&A

|

|

Perfect for CFOs, corporate treasurers, VPs of finance, compliance officers, and board members. The first session goes live September 30. Spaces are limited and discounted for BitcoinTreasories.net subscribers. Secure your seat now: bitcointreasurycourse.com. Use code BITCOINTREASURIES for 15% off.

|

|

|

|

In the past seven days, 13 public companies added their Bitcoin holdings — while the same amount offloaded coins.

|

|

The top 100 now jointly hold 1,002,103 BTC, worth roughly $113 billion at press time.

|

|

Below, we break down the five most aggressive buyers this week — along with how their moves impact the leaderboard.

|

|

|

Top 5 Bitcoin Buys This Week

|

#1 — Strategy (MSTR) 🇺🇸

|

|

|

BTC added: 1,955 BTC Estimated value: ~$217.4 million New total holdings: 638,460 BTC Funding source: Blend of convertible notes and preferred equity Current Ranking: #1 globally % of total supply: ~3.04% YTD BTC Yield: 25.8% mNAV: ~1.3x

|

|

Michael Saylor’s Strategy machine printed another 1,955 BTC this week, pushing its total holdings past 638,000 Bitcoin — more than twelve times its nearest competitor.

The funding mix remains predictably elegant: convertible notes blended with preferred equity, converting capital-market premiums into permanent Bitcoin positions. No forced asset sales — just financial engineering.

With a 25.8% BTC yield year-to-date, Strategy isn’t just accumulating — it’s compounding. Compare Strategy’s premium vs peers: Full Leaderboard.

|

#2 — MARA Holdings (MARA) 🇺🇸

|

|

|

BTC added: 1,838 BTC Estimated value: ~$204 million New total holdings: 52,477 BTC Funding source: Mining revenue retention + ATM equity facility Current Ranking: #2 globally % of total supply: ~0.25% mNAV: ~0.9x

|

|

MARA added 1,838 BTC via mining retention and ATM facility draws, cementing its position as the dominant miner-treasury hybrid.

The transformation is complete: mining mints BTC; equity markets fund operations. The result is perpetual accumulation regardless of spot price — a playbook other miners will emulate. See how MARA stacks up: Miner Rankings.

|

#3 — Metaplanet (MTPLF) 🇯🇵

|

|

|

BTC added: 136 BTC Estimated value: ~$15.1 million New total holdings: 20,136 BTC Funding source: Yen-denominated bonds + preferred equity Current Ranking: #6 globally % of total supply: ~0.096% mNAV: ~1.5x

|

|

Japan’s Metaplanet crossed 20,000 BTC, but the story is structural: its preferred equity offering pegged at 25% of BTC NAV creates a financing floor that survives deep drawdowns. In a high-tax environment, Metaplanet’s premium isn’t speculation — it’s tax arbitrage.

With ~$15M raised for 136 BTC, Metaplanet shows that smart structure can beat sheer size. Explore the structure: Details.

|

#4 — Cipher Mining (CIFR) 🇺🇸

|

|

|

BTC added: 351 BTC Estimated value: ~$39 million New total holdings: 1,414 BTC Funding source: Mining revenue retention Current Ranking: #37 globally % of total supply: ~0.007%

|

|

Cipher quietly stacked 351 BTC through pure mining retention. No complex instruments, no dilution — just disciplined accumulation from a low-cost operator. At current rates, Cipher could crack the top 20 within months.

See which miners are climbing: Full Miner Rankings.

|

#5 — BitFuFu (FUFU) 🇸🇬

|

|

|

BTC added: 190 BTC Estimated value: ~$21.1 million New total holdings: 1,899 BTC Funding source: Mining revenue + operational cash flow Current Ranking: #32 globally % of total supply: ~0.009%

|

|

Singapore’s quiet accumulator is making noise. As one of the few Asian miners with public-market access, BitFuFu offers hash-rate exposure for Western investors, regulatory clarity from Singapore, and proximity to cheaper Asian energy markets.

The 190 BTC addition signals a shift toward miner-treasury retention rather than opex liquidation. Explore how Asian miners are reshaping the race: Regional Leaderboard.

|

|

|

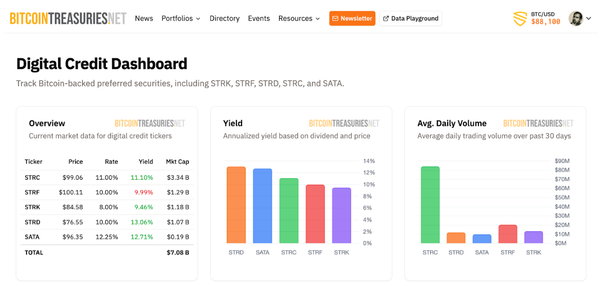

Want the full leaderboard, charts, and week-to-week shifts? See the full Bitcoin Treasuries dashboard. |

|