Bitcoin Balance Sheet #007

Tracking this week's most significant corporate Bitcoin acquisitions

Tracking this week's most significant corporate Bitcoin acquisitions

August 04, 2025 | Read Online

Bitcoin Balance Sheet #007

Tracking this week's most significant corporate Bitcoin acquisitions.

Hello and welcome to Bitcoin Balance Sheet, the new twice-weekly email from Bitcoin Treasuries, where we track the latest in corporate Bitcoin buying.

Each Monday, you'll receive a quick blast on the top buyers over the last week.

We'll follow that up every Friday with digest and analysis.

Enjoy!

The Bitcoin Treasuries NYC Unconference: Tickets Running Out

We’re partnering with Tim Kotzman and the Bitcoin Treasuries NYC Unconference for a one-day deep dive into Bitcoin corporate strategy.

Join us Wednesday, Sept 17 (9am–5pm) in New York to network, workshop, and hear from star guests including:

- Michael Saylor (Strategy)

- Jeff Park (Bitwise)

- Grant Cardone

- Tim Kotzman

- Max Keiser

Get 15% off with our exclusive discount for BitcoinTreasuries.net readers: DOTNET15.

This event will fill up fast.

Reserve your seat now: The BTC Treasuries Unconference.

Corporate Bitcoin treasuries remain unfazed by the fact that Bitcoin has slid 3.7% to $114,300 this week.

The top cryptocurrency has been consolidating since it topped its record high of $123,000 in mid-July.

Instead of retreating, a new wave of strategic buys is propelling the leaderboard to fresh highs, now totaling 954,582 BTC across the top 100 public companies.

That amounts to a staggering $109 billion in Bitcoin under management.

Coinbase (COIN) returned to form with a 2,509 BTC acquisition, vaulting it back into the top 10.

For a company that long distanced itself from Bitcoin-first narratives, the move signals a striking reversal.

It also puts pressure on peers like Binance and Kraken to follow suit.

Meanwhile, Strategy (MSTR) continues its meteoric climb, adding 21,021 BTC this week and surpassing the 3% mark of total supply.

Michael Saylor’s playbook of recurring preferred equity raises is increasingly becoming the blueprint for corporate BTC scaling.

XXI (CEP) isn’t far behind.

With a 6,284 BTC buy, Jack Mallers’ firm leapfrogged BSTR to claim the #3 spot.

If it continues at this pace, XXI may soon become the first challenger to close the gap with Marathon (MARA) and then Strategy.

Across the Atlantic and Pacific, Sequans (France) and Anap (Japan) expanded the leaderboard’s geographic footprint.

Anap’s debut in this recap signals that Bitcoin’s treasury appeal is reaching non-financial sectors like fashion and consumer retail.

In total, 17 public companies increased their BTC holdings this week.

Below, we break down the top five buyers and how their strategies are reshaping the Bitcoin corporate stack.

Top 5 Bitcoin Buys This Week

#1 — Strategy 🇺🇸

- BTC added: 21,021 BTC

- Estimated value: ~$2.4 billion

- New total holdings: 628,791 BTC

- Funding source: Preferred equity and convertible notes

- Current Ranking: #1 globally

- % of total supply: ~3.16%

- Already holds: 12x more BTC than next largest firm

- YTD BTC Yield: 20.8%

Strategy continues to scale its allocation with precision.

This week’s 21,021 BTC purchase cements its place as the corporate Bitcoin hegemon.

With over 3% of circulating supply under management, it is unmatched.

The raise was funded via a new Series B Stretch equity offering — its fifth since 2021.

In contrast to typical tech buybacks, Strategy’s model converts capital into BTC with high velocity.

With no challengers in sight, Strategy is not just setting the benchmark for financial engineering in Bitcoin capital markets.

It is transforming them altogether.

Key Takeaways

- Coinbase returns to the top 10 with a 2,509 BTC purchase, signaling a strategic shift as the exchange embraces Bitcoin as a treasury reserve.

- Strategy extends its dominance, adding 21,021 BTC and surpassing 3% of all Bitcoin in circulation.

- XXI jumps into the #3 spot, overtaking BSTR with a 6,284 BTC buy — its most aggressive move yet.

- Anap Holdings makes a surprise debut, becoming Japan’s second corporate Bitcoin holder with a 646 BTC allocation.

- 17 companies increased their holdings this week, continuing 2025’s record-setting pace for corporate Bitcoin accumulation.

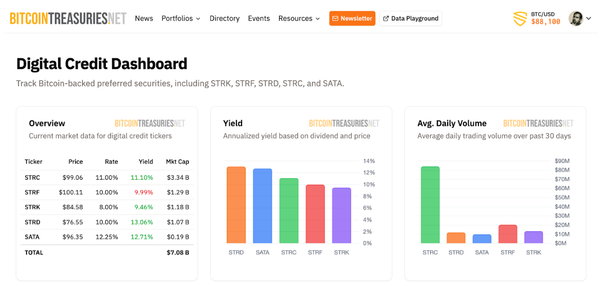

Over To You: What Do You Track?

We want to make this the go-to resource for corporate Bitcoin strategy — and that means learning from our readers.

- What metrics or dashboards do you rely on to track the space?

- Which signals would you like us to explore in more depth?

- What tools would you like to see us integrate?

You can help shape the direction of this newsletter in 10 seconds.

Just hit reply, we read everything.

For more information: