Bitcoin Balance Sheet #001

Tracking this week’s most significant corporate Bitcoin acquisitions

Tracking this week’s most significant corporate Bitcoin acquisitions

July 14, 2025 | Read Online

Bitcoin Balance Sheet #001

Tracking this week’s most significant corporate Bitcoin acquisitions

Hello and welcome to Bitcoin Balance Sheet, the new twice-weekly email from Bitcoin Treasuries, where we track the latest in corporate Bitcoin buying.

Each Monday, you'll receive a quick blast on the top buyers over the last week. We’ll follow that up every Friday with digest and analysis. Enjoy!

All-time high conviction

Bitcoin broke into uncharted territory over the weekend, nearing $123,000 to mark a new all-time high. It has since dropped slightly on US market open.

But while headlines fixate on price action, institutions are focused on long-term positioning. Balance sheets are swelling, and the race to secure a slice of the 21 million supply continues at full speed.

In just the past week, 13 public companies expanded their Bitcoin holdings — a signal that corporate conviction is in full throttle.

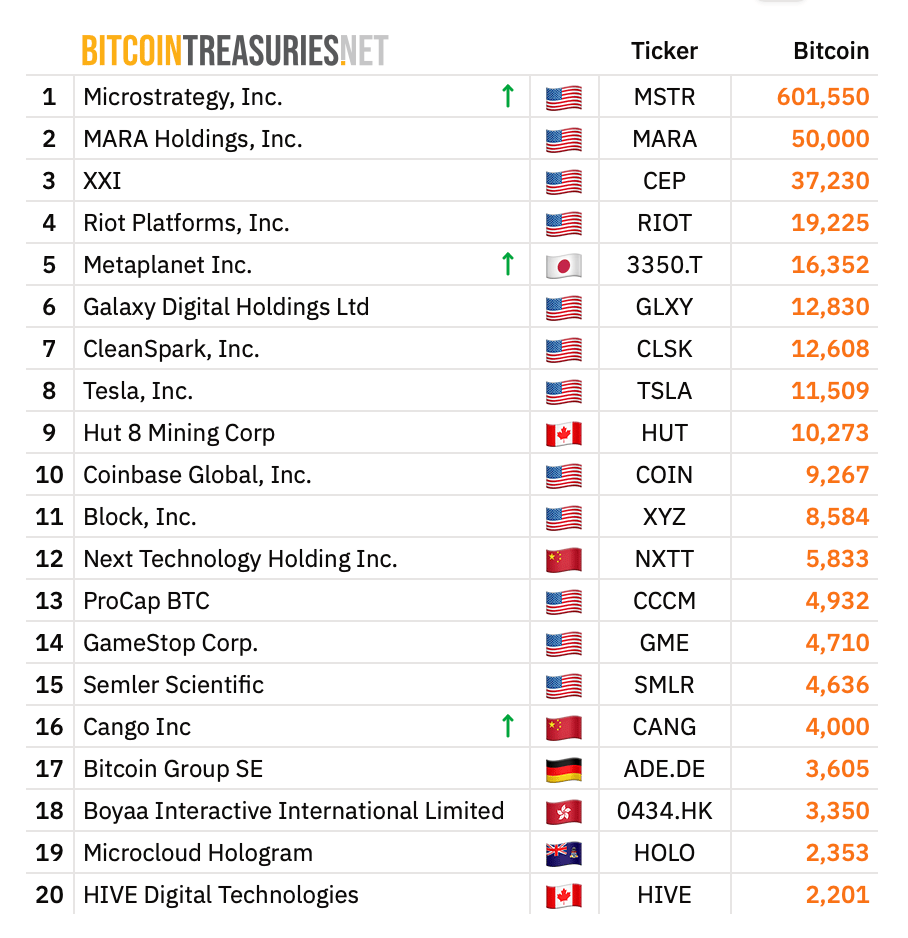

Together, the top 100 public holders now command 853,621 BTC, worth over $104 billion.

Below, we break down the five biggest buyers this week — how they funded their acquisitions, where they now sit in the rankings, and what their moves signal about the evolving Bitcoin treasury landscape.

Top 5 Bitcoin Buys This Week

#1 — Strategy 🇺🇸

- BTC added: 4,225 BTC

- Estimated value: ~$472.5 million

- New total holdings: 601,550 BTC worth about $73 billion

- Funding source: Proceeds from preferred stock issuance (Series F)

- Ranking: #1 among public companies

- % of total supply: ~2.86%

- YTD BTC yield: 20.2%

- BTC per share: 0.00214106

- Market NAV multiple: 1.669×

Strategy remains in a league of its own.

This week’s 4,225 BTC acquisition pushes its total to over 601,000 BTC — nearly 3% of all Bitcoin that will ever exist.

Its cost basis sits at $42.87 billion, with a current portfolio value of ~$73.4 billion.

The market NAV multiple now stands at 1.669×, and YTD BTC yield at 20.2%. Its Bitcoin per share remains the highest of any public company by an order of magnitude.

#2 — Metaplanet 🇯🇵

- BTC added: 2,205 BTC

- Estimated value: ~$235.9 million

- New total holdings: 16,352 BTC worth about $1.99 billion

- Funding source: Yen-denominated corporate bond issuance (Series 3)

- Ranking: #5 among public companies

- % of total supply: ~0.0636%

- BTC-to-market-cap ratio: ~26.5%

Metaplanet continues its aggressive accumulation strategy, mirroring the MicroStrategy playbook.

Its broader “210 Million Plan” aims to raise $5.4 billion by 2027 to acquire 210,000 BTC — about 1% of supply.

This week’s purchase raised its BTC-to-market-cap ratio to 26.5%. Metaplanet now needs ~3,670 BTC to overtake Riot Platforms and reach the #4 spot.

#3 — The Smarter Web Company 🇬🇧

- BTC added: 501.43 BTC

- Estimated value: ~$55.2 million

- New total holdings: 1,275 BTC worth about $155 million

- Funding source: Internal cash reserves

- Ranking: #28 among public companies

- % of total supply: ~0.0061%

- BTC > market cap: Yes

This UK firm has more than doubled its holdings since June, now less than 1,000 BTC away from the top 20.

Its Bitcoin position is worth more than its market cap. BTC-to-enterprise-value and BTC-per-employee ratios are among the highest in the non-mining segment.

This is its largest weekly purchase yet, reflecting a trend of smaller-cap firms steadily building exposure.

#4 — Sequans Communications 🇫🇷

- BTC added: 1,053 BTC

- Estimated value: ~$128 million

- New total holdings: 1,053 BTC worth about $128 million

- Funding source: Not disclosed

- Ranking: #46 among public companies

- % of total supply: ~0.0017%

- New entrant: Yes

- BTC needed for top 40: ~200 BTC

The Paris-based semiconductor firm initiated its Bitcoin strategy this week, immediately landing in the top 40 public holders.

If this continues, Sequans could quickly break into the top 30, setting a new blueprint for mid-cap European corporates.

#5 — DDC Enterprise Limited 🇺🇸

- BTC added: 230 BTC

- Estimated value: ~$28.1 million

- New total holdings: 368 BTC worth about $44 million

- Funding source: Not disclosed

- Ranking: #22 among public companies

- % of total supply: ~0.0017%

- BTC needed for top 20: ~500 BTC

DDC added 230 BTC, bringing its total to 368 BTC.

That puts it within ~200 BTC of overtaking Argentina’s Mercado Libre and landing in the top 40.

Founded in 2012 in New York, DDC operates as DayDayCook, offering meals, cooking content, and e-commerce services across China, Hong Kong, and the U.S.

The company’s strategy highlights growing appetite for Bitcoin exposure beyond tech and finance.

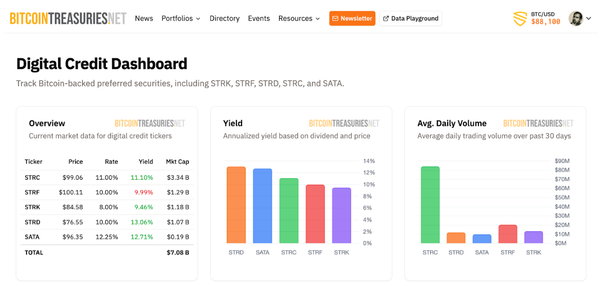

Leaderboard Snapshot

This week’s leaderboard was defined by large-cap conviction and emerging players. Strategy widened its lead, Metaplanet closed in on Riot, and firms like Smarter Web, Sequans, and DDC gained ground in the mid-tier.

Key Takeaways

- New ATH, same Saylor strategy: Strategy added 4,225 BTC, sticking to equity-backed accumulation.

- Asia keeps pushing: Metaplanet remains the most aggressive non-US buyer with bond-financed BTC growth.

- Non-mining firms step up: Smarter Web and Sequans show Bitcoin treasuries aren’t just for miners.

- Leaderboard momentum is real: Metaplanet is one big buy away from the Big 4. Smarter Web nears the top 20.

- BTC yields add up: Strategy and others are now outperforming traditional equity benchmarks on treasury BTC alone.

Coming Friday: Trend & Strategy Edition

We’ll break down:

- How Strategy’s preferred shares unlock new Bitcoin leverage

- Why Asia’s bond-funded buys could redefine treasury risk

- What it takes to move up the leaderboard — and who’s close to breaking in

Discover everything about the Bitcoin treasury world

BitcoinTreasuries.NET - Top Bitcoin Treasury Companies

Track Bitcoin holdings of public companies, governments, and institutions. Live data with real-time valuations.