Balance Sheet Losses Hit 60% of Corporate Bitcoin Treasuries: Full Analysis

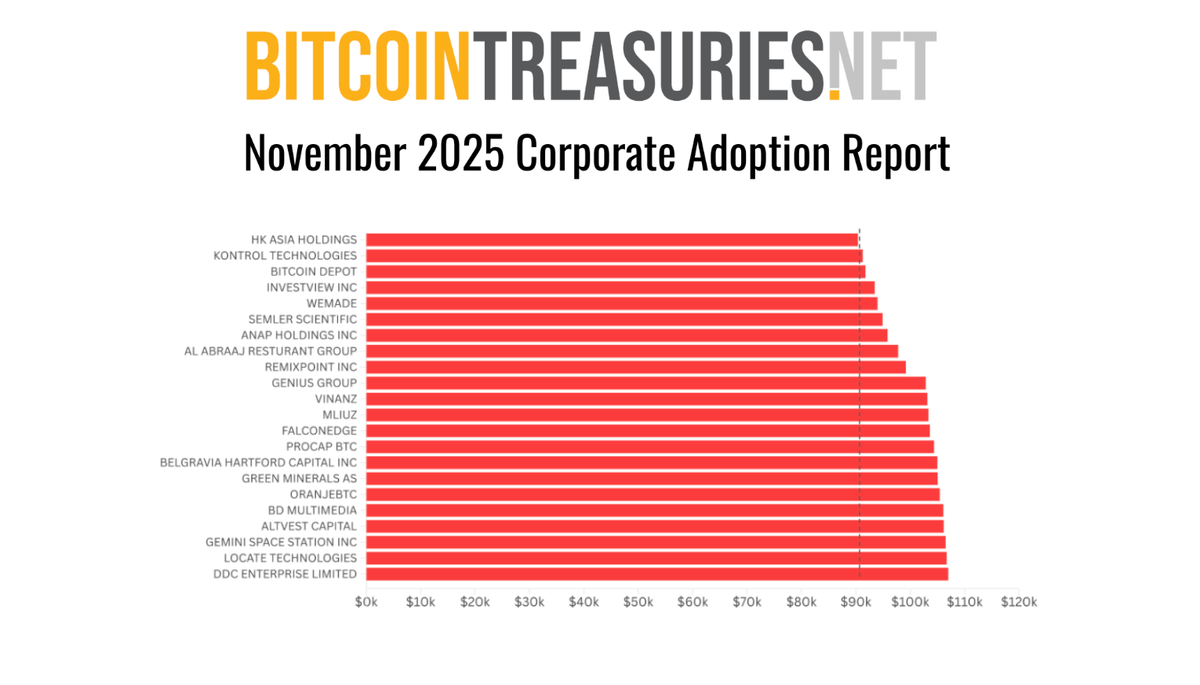

November may have been the first true stress test of the Bitcoin capital markets era, as what began as a month of guarded optimism gave way to sharp volatility as Bitcoin’s price broke below $90,000 – defying prior cycle patterns and exposing just how aggressively many corporates chased this year’s rally.

The November edition of the BitcoinTreasuries.net Corporate Adoption Report quantifies this impact across public companies using Bitcoin as a balance sheet tool, distilling the data into more than 100 charts and slides.

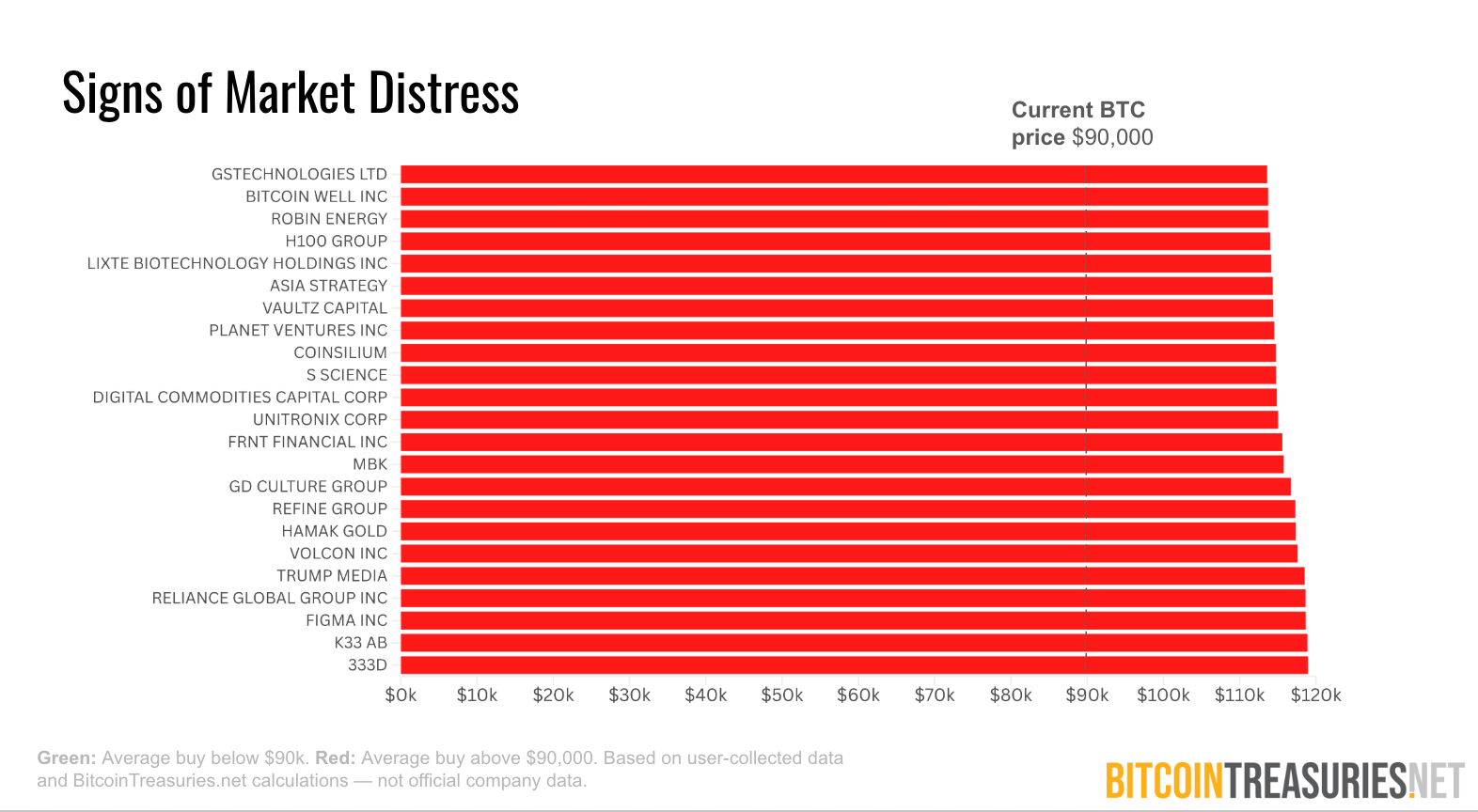

Our headline finding: in a sample of 100 companies where cost basis can be reliably measured, an estimated 65% bought Bitcoin above current market prices, leaving a clear majority of these treasuries with unrealized losses.

Overall, the report provides the strongest evidence yet that headline BTC balances can conceal substantial mark‑to‑market pressure when the asset price corrects.

1. Majority of treasuries appear underwater on Bitcoin buying

Bitcoin’s late‑November drawdown pushed spot prices toward $90,000, dragging many 2025 buyers into the red. For the 100 companies where cost basis could be measurable, about two‑thirds now sit on unrealized losses at current prices.

This does not yet point to widespread distress, but it does force risk committees and boards – to confront the downside of averaging into elevated prices and relying on long-term upside to validate treasury decisions.

2. Big treasuries still dominate the bid

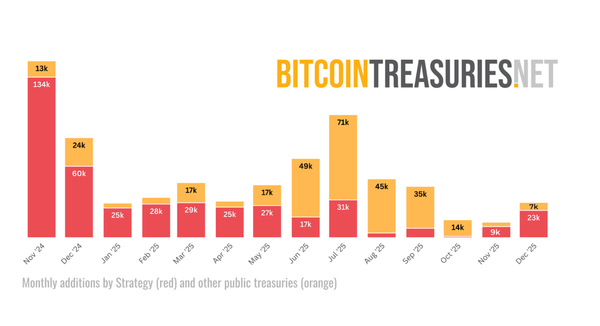

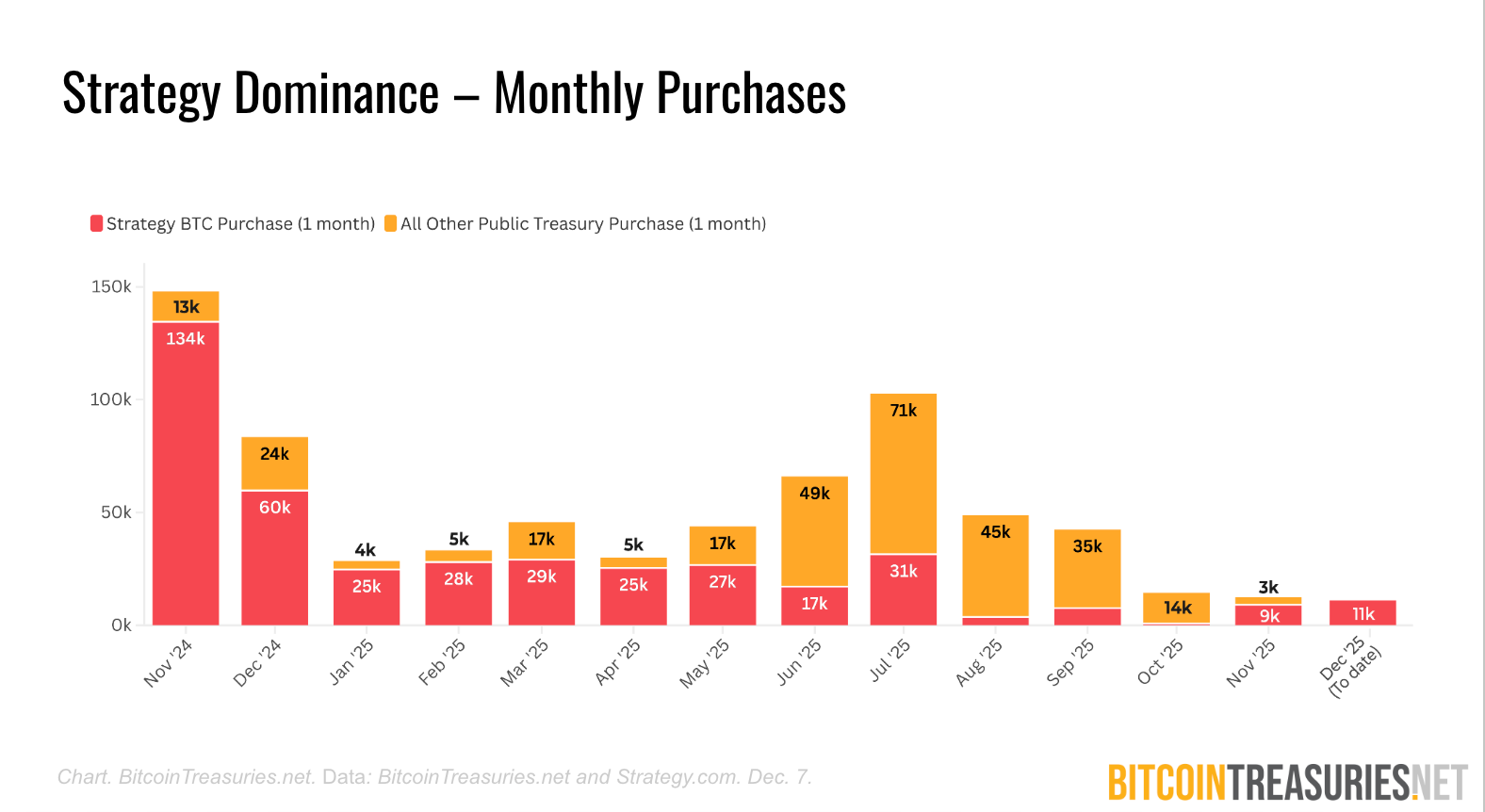

Despite volatility, the biggest balance sheets kept buying. Major Bitcoin treasuries such as Strategy and Strive dominated net additions in November, with Strategy accounting for roughly 75% of all monthly purchases after sales.

This reverses October’s trend toward diversification and re‑concentrates leadership in a small cohort of high‑conviction allocators. For now, the market remains top‑heavy: a handful of aggressive buyers are still defining the cadence and scale of public company accumulation.

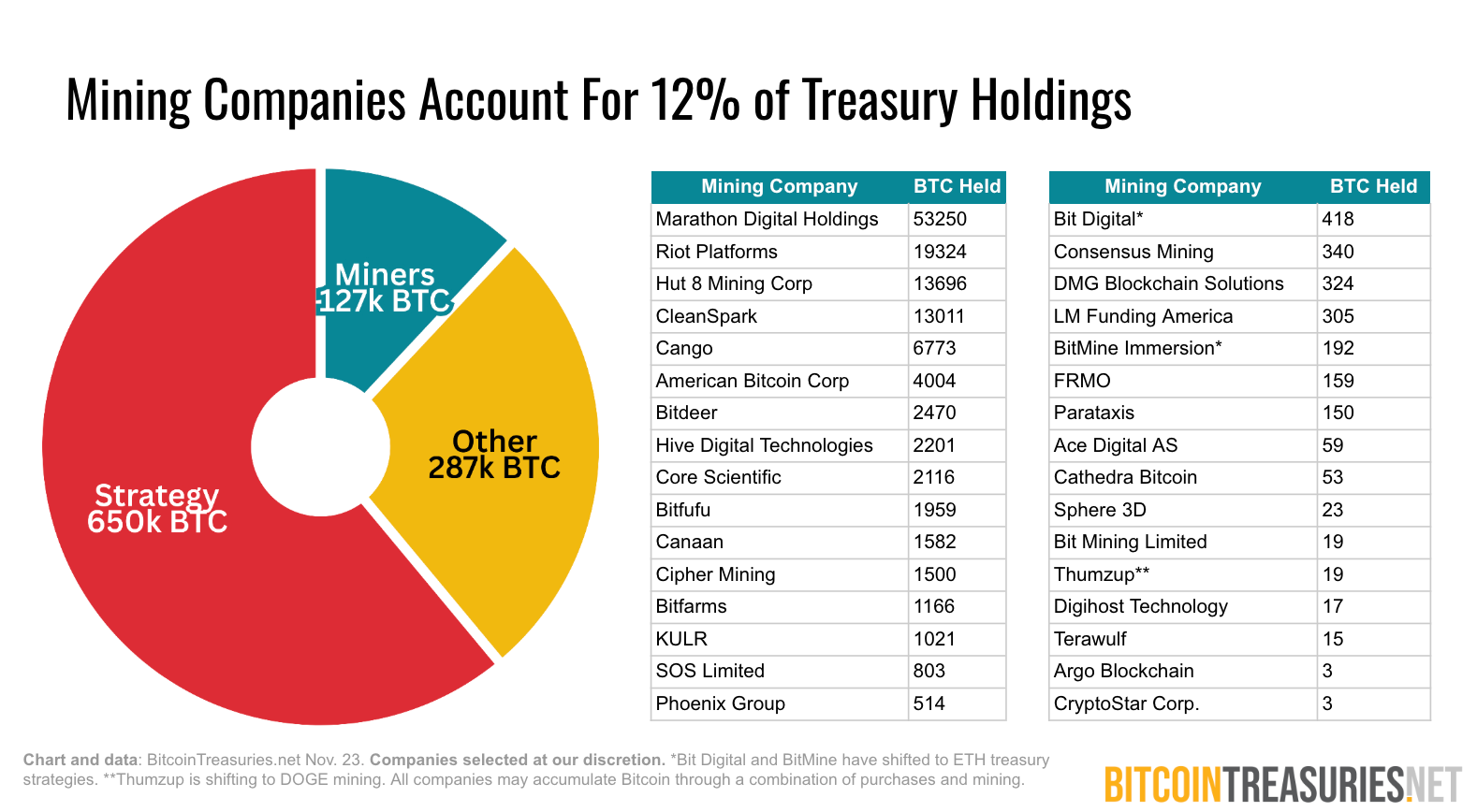

3. Miners remain systemically important Bitcoin holders

Mining companies continue to anchor public‑market Bitcoin holdings. In November, miners represented roughly 5% of new additions and around 12% of aggregate public company balances, underscoring their ongoing structural role even in a higher‑price environment.

Because miners can acquire BTC at an effective discount to spot markets via block production, their balance sheets may become increasingly important in supporting corporate adoption, especially if other treasuries pause or slow purchases.

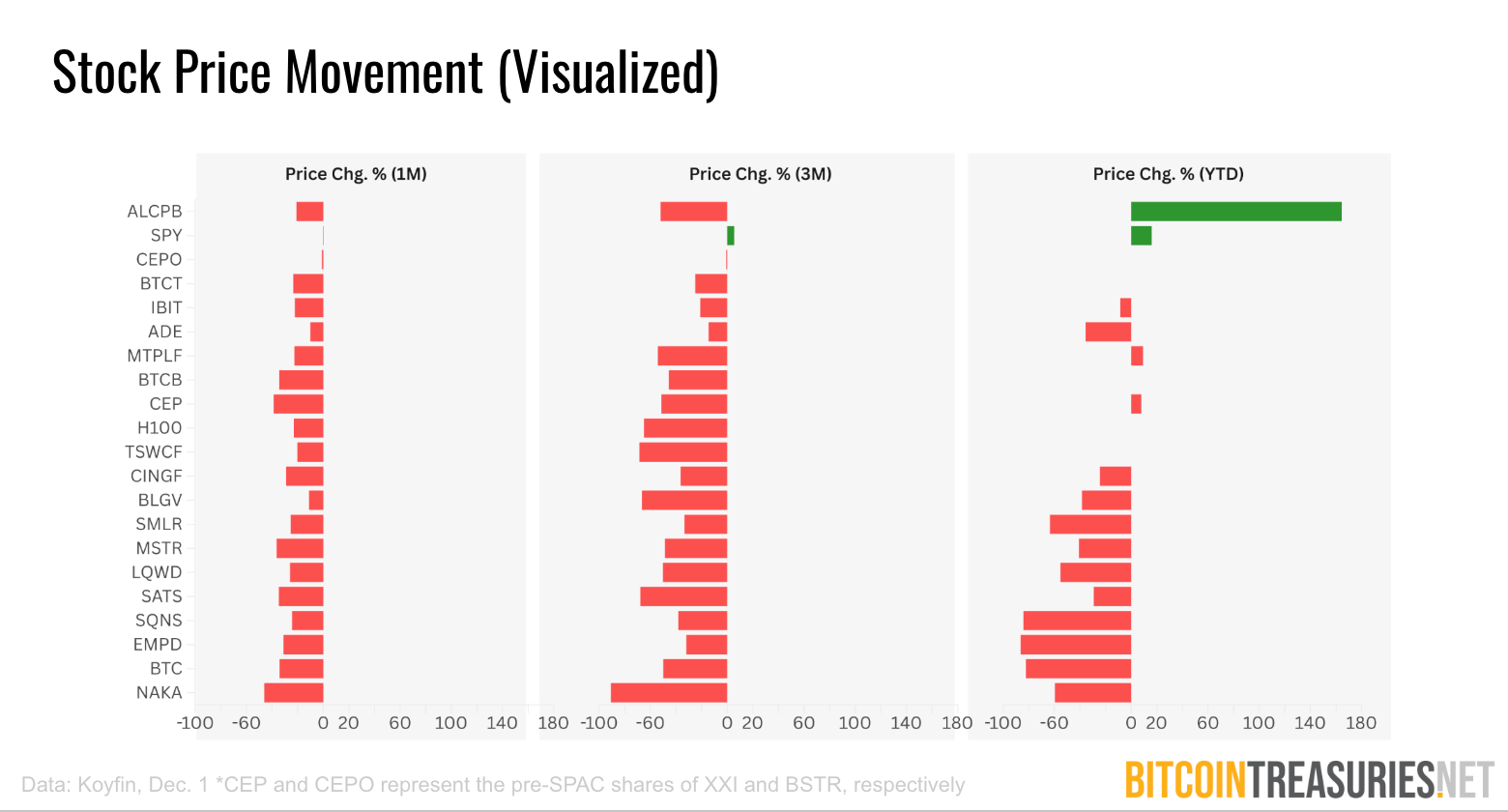

4. Treasury stocks are weak, but long-term value remains

Public Bitcoin treasury stocks remain soft relative to both Bitcoin and broad equity benchmarks, even as many continue to add BTC and refine capital‑markets strategies. Yet analysis indicates that nearly 50 companies have delivered at least 10% gains over the past 6–12 months.

Furthermore, time has mitigated losses: about 140 companies are down at least 10% over 1-3 months, whereas only about 105 companies are down at least 10% year-to-date.

Even in a choppy market, the most disciplined treasury and capital‑markets strategies can still generate moderate gains or resist stock devaluation.

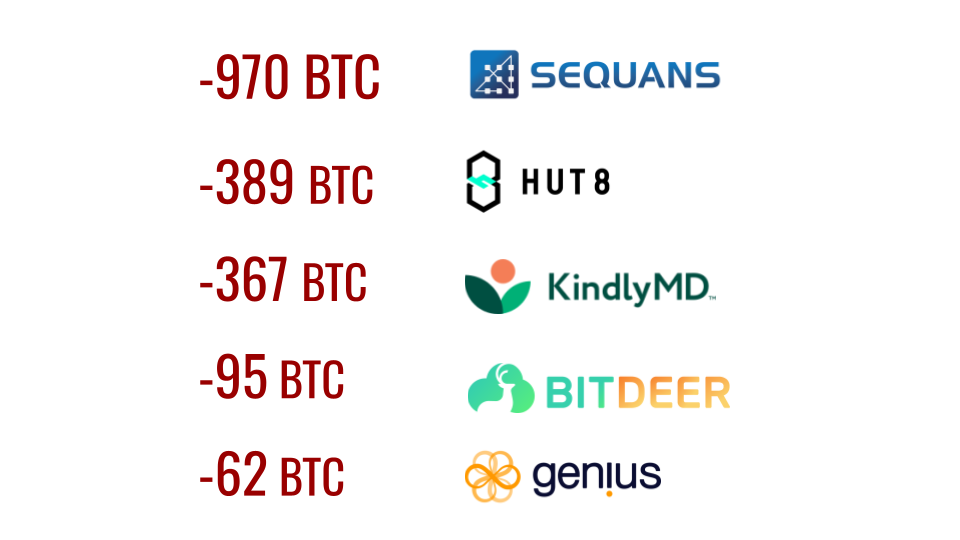

5. Selling emerges at the margin

Not every corporate holder chose to ride out the volatility. At least five companies sold Bitcoin in November, led by Sequans’ decision to dispose of roughly one‑third of its holdings. (See our full coverage and analysis).

While small in aggregate terms, these sales highlight that some management teams are willing to crystallize losses or de‑risk when Bitcoin corrects sharply – an important signal for future drawdowns.

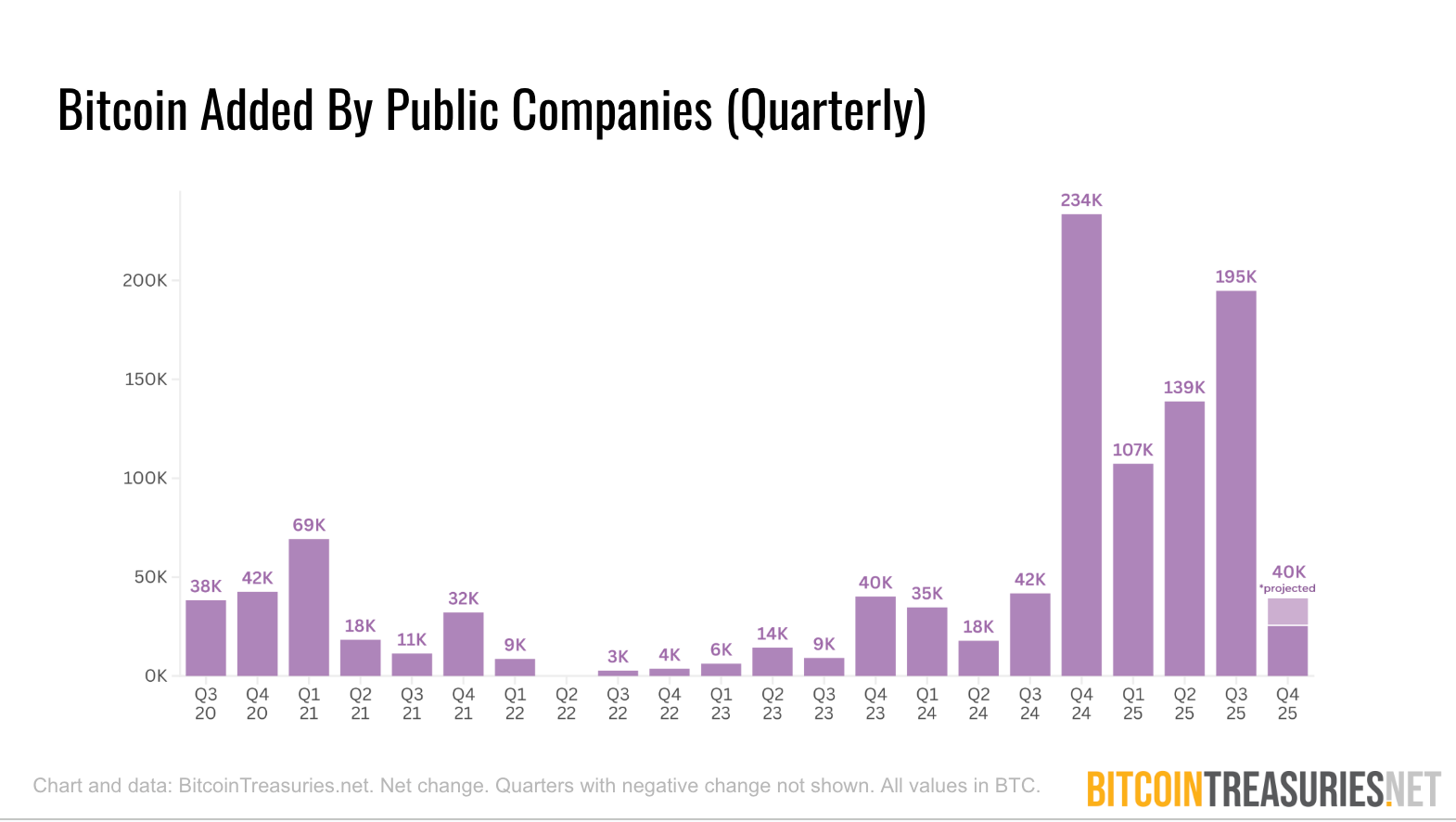

6. Quarterly momentum is cooling, not collapsing

Q4 2025 is projected to close with approximately 40,000 BTC added to public company balance sheets – below each of the prior four quarters, and roughly in line with Q3 2024.

This estimate is based on amounts purchased over the past two months and takes into account Strategy’s purchases in early December.

Overall, while the “summer buying frenzy” has clearly eased, demand has not vanished. Rather, public corporations appear to be normalizing to a slower, more selective cadence as they digest recent purchases and reassess risk.

For further analysis, or to discuss trends driving your investment or treasury strategy, reach our research team at office@bitcointreasuries.net.