Analyst Brief: 100+ Slides on Bitcoin's Treasury-Powered Digital Credit Boom

October brought dramatic shifts in the corporate digital asset landscape.

What began as a month of high anticipation – with Bitcoin prices hitting all-time highs before global macro shocks – ended with the sector not just weathering the storm, but demonstrating remarkable resilience and adaptation.

Indeed, the October BitcoinTreasuries.net Corporate Adoption Report reveals that, while momentum remains strong, the sector’s leading players are aggressively diversifying their strategies, ushering in a new era for digital assets and yield-driven corporate finance.

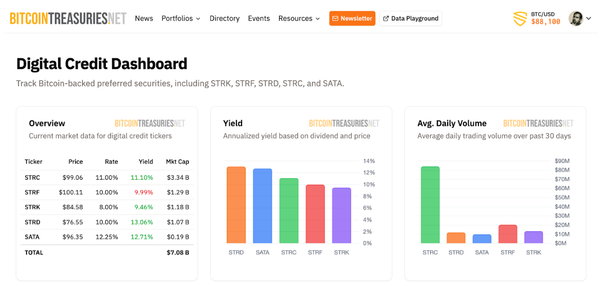

1. Digital Credit Innovation Emerges

Digital credit offerings are gaining steam as Strategy, Strive, and Metaplanet push forward with innovative preferred share and dividend strategies. Many offerings now target dividend yields in the range of 8-12% annually, attracting equity and fixed-income investors alike.

Meanwhile, Strategy is extending its preferred shares into the EU with STRE and is considering other global offerings in the future, marking a new era in yield-focused digital credit.

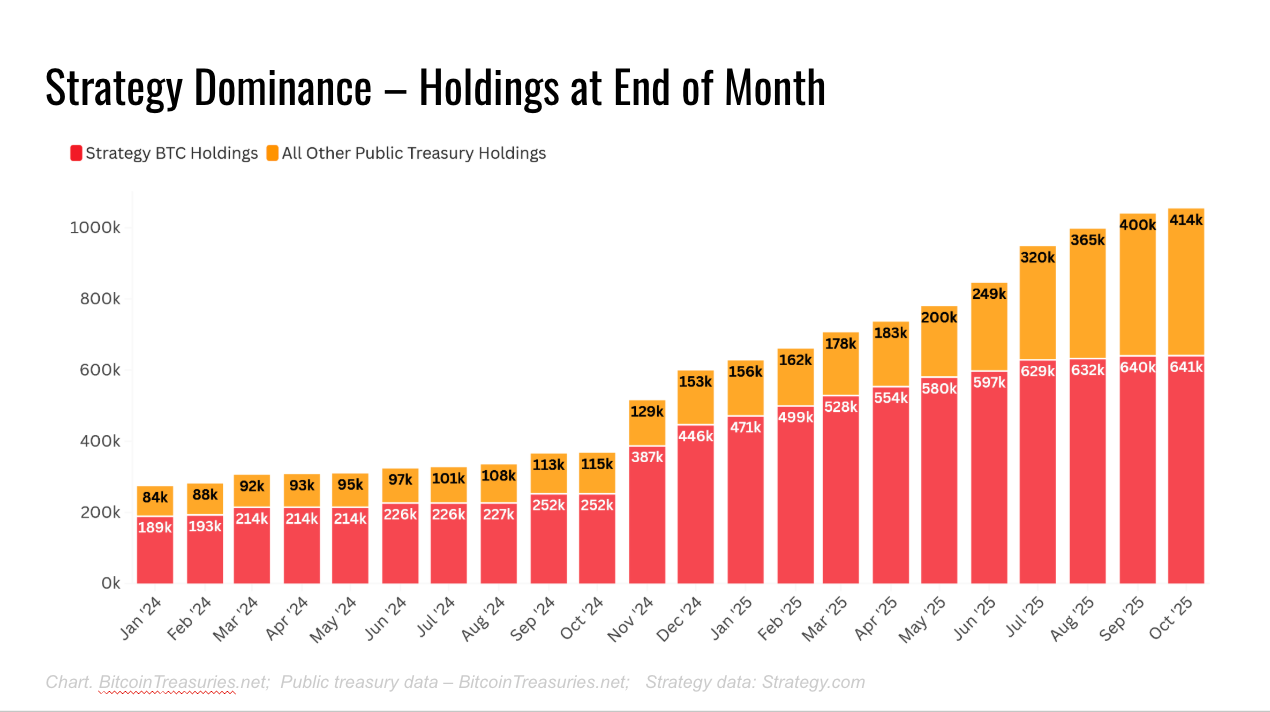

2. Corporate Holdings: Strategy's Dominance Declines

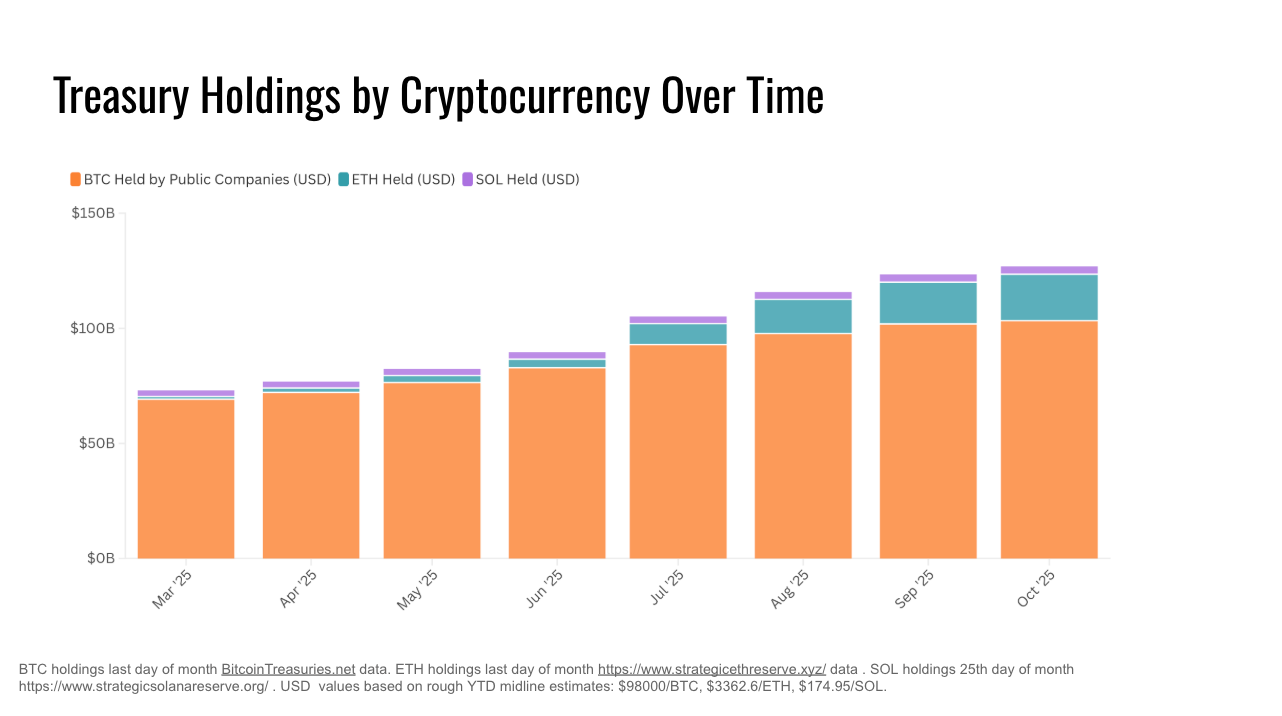

Public companies’ total Bitcoin holdings are now above 1.05 million BTC, though October saw the fewest monthly additions year-to-date. The continued rise in total holdings signals continued confidence among public firms despite reduced buying compared to past months.

Indeed, one notable trend is the sector's diversification away from the market's pioneer, Strategy. Strategy now accounts for just 60% of all treasury holdings, down from 75% in January 2025

3. Outperformance in Treasury Equities

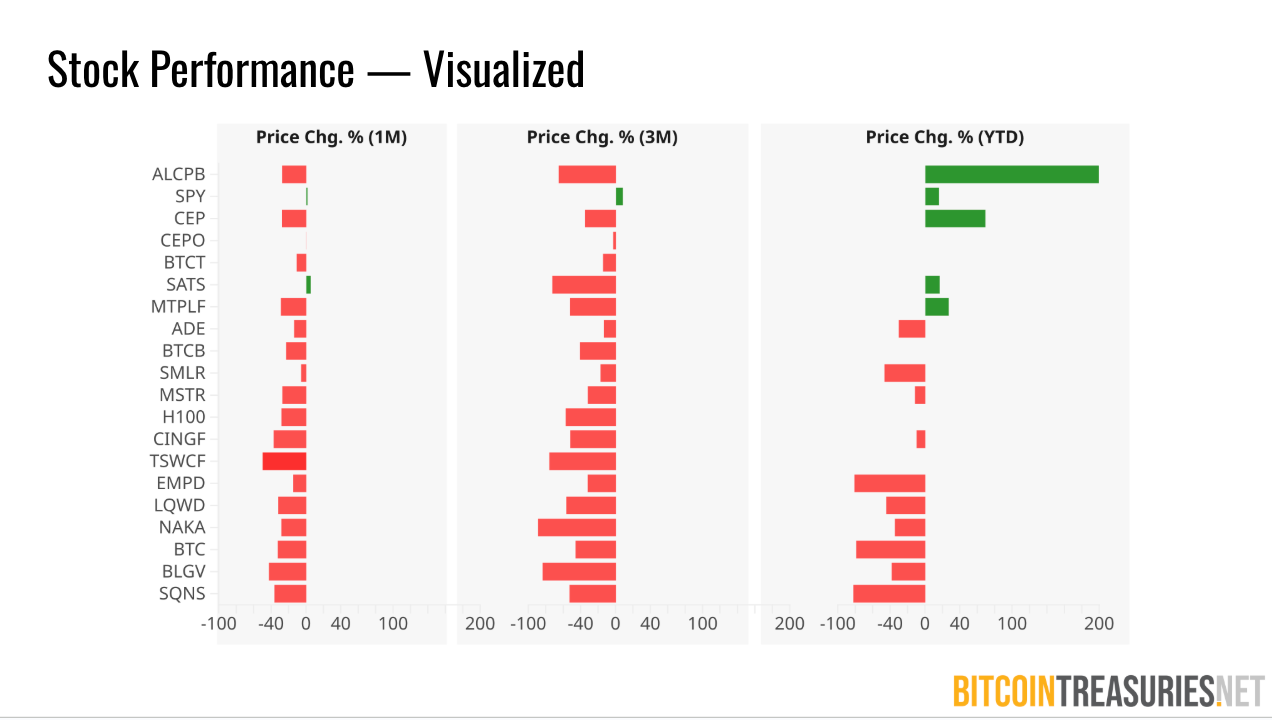

Select “pure play” Bitcoin treasury stocks including Capital B, Metaplanet, and Satsuma, and XXI’s pre-SPAC shares (CEP) – have notably outpaced the S&P 500 year-to-date. Investors are taking notice: these BTC-levered public companies demonstrate that even during sector corrections, disciplined treasury strategy can drive significant relative equity gains.

4. Altcoin Treasuries: Ethereum Gains Prominence

Ethereum (ETH) and Solana (SOL) now account for a growing share of corporate digital asset treasuries. Of particular note, Ethereum represents approximately 15% of the total dollar value across publicly traded BTC, ETH, and SOL treasuries – up from just 2.5% earlier this year – showing that public firms have a diverse interest in crypto asset treasuries.

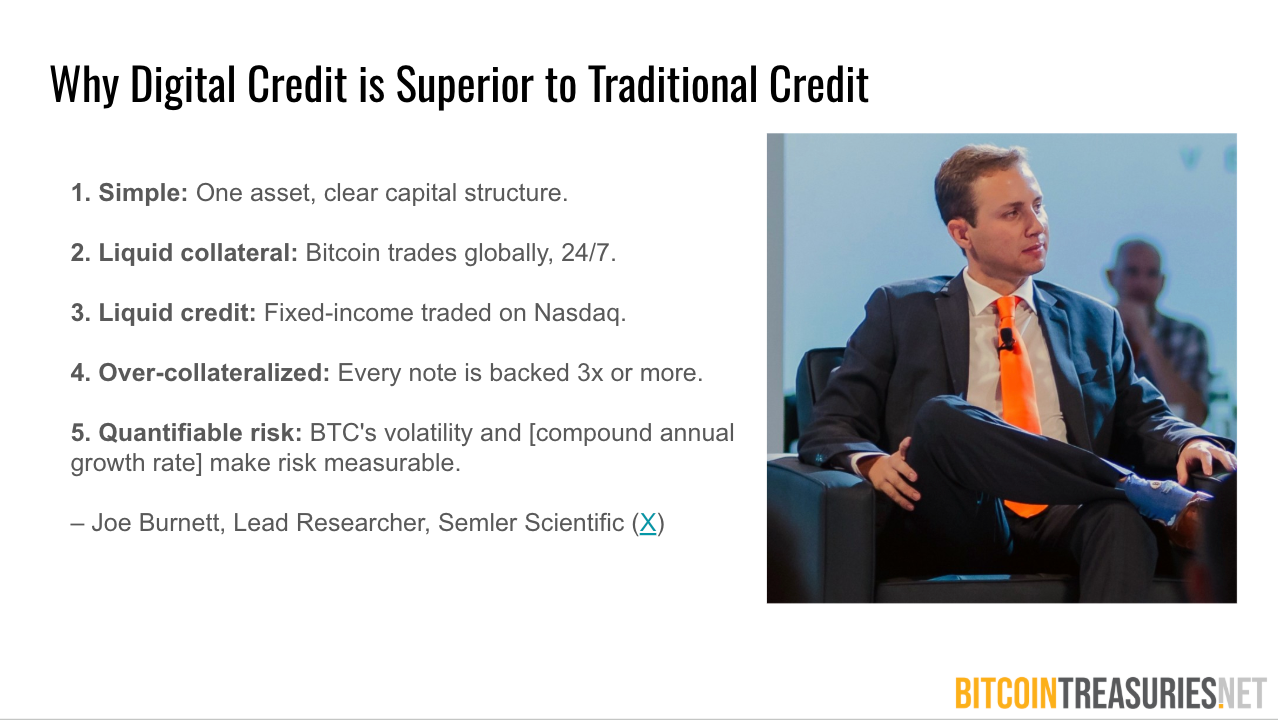

5. Experts Assess the Treasuries Landscape

Expert insights for this report were provided by John Fakhoury, CEO of Stacking Sats Inc., Joe Burnett, Lead Researcher at Semler Scientific, Adrian Morris, Lead Equity Analyst at MSTR True North; Adam Livingston, Bitcoin and capital markets educator, Ethan Peck, Director of Bitcoin at Strive Asset Management, and Brian Dixon, CEO of Off The Chain Capital.

Their perspectives and market analyses, featured throughout the report, highlight developments in Bitcoin treasury strategy and underscore trends shaping institutional adoption.

Elsewhere, our report explores:

- How share buyback financing is impacting Bitcoin treasury equities

- Strategy’s forthcoming launch of international preferred stock offerings

- $10 billion in fundraising developments, with $1.4 billion related to Bitcoin treasuries

- How new strategies from Bitcoin staking to strategic Bitcoin sales are redefining the Bitcoin treasury playbook

For further analysis or to discuss trends driving your investment or treasury strategy, reach our research team at office@bitcointreasuries.net.